The Wall Street is most likely one of the most well-known and famous streets in the world, located in New York City. However, its value extends beyond basic infrastructure.

This Guide Will help you to understand Everything, what is Wall Street, what is its history, and why is it significant for investing and trading? Here’s what you should know.

What Is Wall Street?

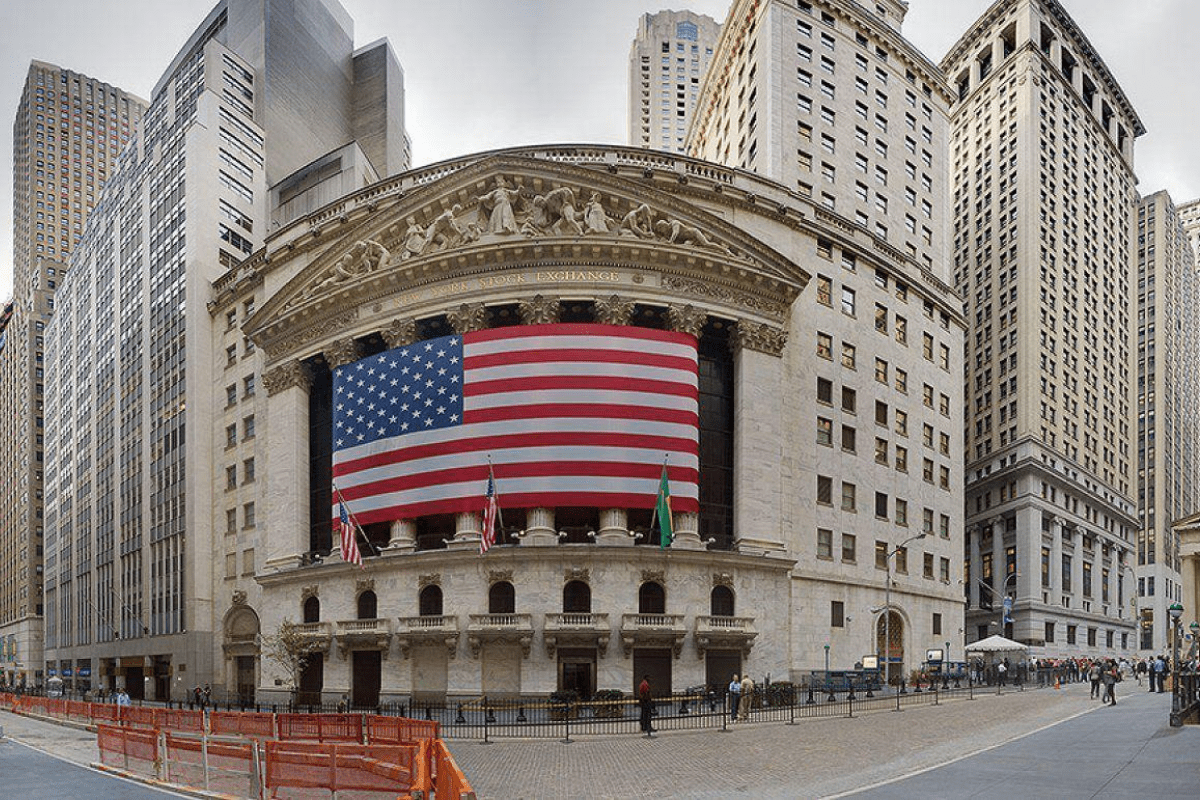

Wall Street is a roadway in New York City’s Financial District, namely in Lower Manhattan. It spans eight city blocks from Broadway in the west to South Street and the East River in the east12.

Figuratively, Wall Street signifies much more than simply a geographical location; it is synonymous with the financial industry and the organizations that comprise it. Historically, several brokerage firms and investment banks placed their offices on or near Wall Street in order to be proximate to the New York Stock Exchange (NYSE).

While being on or near Wall Street is no longer required for financial institutions, the word “Wall Street” nevertheless refers to the investing industry and the interests of its participants. Events on or near Wall Street frequently affect not just the investment industry but also the U.S. and global economy

Important Takeaways

- Wall Street is a street in the Lower Manhattan neighbourhood of New York City.

- Wall Street is an umbrella word for the financial markets and corporations that trade openly on exchanges across the United States.

- Wall Street has long been home to some of the major brokerage and investment banking firms in the United States, as well as the NYSE.

- Wall Street is sometimes compared with Main Street, which is a metaphor for local enterprises and private investors.

- Events on or around Wall Street frequently have an impact not only on the investing business but also on the U.S. (and even global) economies.

It is a widely recognized expression that, to some extent, always alludes to the United States’ financial system. The NYSE (the world’s largest stock exchange) and the Federal Reserve Bank of New York—arguably the most important regional bank of the Federal Reserve System—are both headquartered in the Wall Street neighbourhood.

Wall Street is usually reduced to “the Street,” as it is used by financial professionals and the media. For example, while reporting a company’s earnings, an analyst may compare the company’s revenues to what the market expected. In this situation, the analyst compares the company’s results to what financial experts and investment firms expected during that time period.

The Importance of Wall Street

Wall Street has had a significant economic and cultural impact.

Economic Importance

The United States is the world’s largest economy, and New York City serves as its financial centre. As a result, Wall Street’s global impact is unrivalled.

Wall Street is home to some of the world’s largest financial institutions, employing hundreds of thousands of people. It is home to the NYSE and Nasdaq stock exchanges, which are among the world’s largest. Amazon, Google, Apple, and Exxon are among the largest corporations listed on these exchanges.

The economic significance of Wall Street extends throughout the American and foreign economies, as many financial firms do business globally, provide loans to a range of businesses and individuals, and finance large-scale, global projects.

Cultural Importance

Wall Street’s cultural influence extends to movies, TV shows, books, and more. Films such as Wall Street, Margin Call, Boiler Room, Barbarians at the Gate and more from previous decades highlight what the fast-paced life is like on Wall Street. They display an exciting wealthy and interesting lifestyle.

Large players on Wall Street have become celebrity icons. Warren Buffett, Jamie Dimon, Carl Icahn, Bernie Madoff, George Soros, and Larry Fink are names familiar to many. In the imaginations of some in contemporary society, the term Wall Street may evoke a sense of power, the elite, and often, evil behaviour.

During times of economic hardship, such as the 2008 financial crisis, Wall Street can become a scapegoat, and the economy’s ills are blamed on its supposed greed. No other financial phrase has been so ingrained in the global culture.

History Of Wall Street

Wall Street was named after the wooden wall Dutch colonists built in lower Manhattan in 1653 to defend themselves against the British and Native Americans. The wall was demolished in 1699, but the name remained.

Given its proximity to New York’s ports, Wall Street became a thriving trading center in the 1700s. The Buttonwood Agreement, signed in 1792 by 24 of the most significant brokers and merchants in the United States, marked the beginning of its development as a financial hub. They supposedly met on Wall Street, behind a buttonwood tree, to conduct business.

The agreement outlined the common commission-based form of trading securities. In effect, it was an effort to establish a members-only stock exchange. Some of the first securities traded were war bonds and the stocks of such institutions as the Bank of New York.

Out of this acorn of an agreement, the oak that became the NYSE grew. In 1817, the Buttonwood brokers renamed themselves The New York Stock and Exchange Board. The organization rented out spaces for trading in several locations until 1865, when it settled on a location of its own, at the corner of Wall and Broad Streets.

As the United States grew, several additional large exchanges established offices near Wall Street. These included the New York Mercantile Exchange, the New York Board of Trade, the New York Futures Exchange (NYFE), and the American Stock Exchange (now NYSE American Options).

Banks, brokerage firms, and financiers set up offices surrounding Wall Street to support the exchanges and be close to the action. In the late nineteenth and early twentieth century, the House of Morgan, officially J.P. Morgan & Co.—the precursor to JP Morgan Chase and Morgan Stanley—was located right across from the NYSE at 23 Wall Street.

After World War I, New York City eclipsed London as the world’s largest and most important financial hub.

WALL STREET OPEN AND CLOSE TIMING – US Stock Market Time and Trading Hours

Key Events on Wall Street

Events on or around Wall Street frequently have an impact not only on the investing business but also on the world economy and society. Here are some key occasions in Wall Street history.

The Wall Street Generation

1889 – Origin

On July 8, 1889, Charles Dow, Edward Jones, and Charles Bergstresser founded The Wall Street Journal, a four-page afternoon newspaper that focused on impartial financial and economic news. The three men were reporters, but Dow was also a numbers man who devised the notion of developing a benchmark list of firms and their stock values to reflect the entire stock market.

The Wall Street Journal. “130 Years of History as Seen in the Pages of The Wall Street Journal.”

Soon, the Journal began posting the Dow Jones Industrial Average (DJIA) index, as well as hundreds of firm stock, bond, and futures values, as well as the average prime rate for bank loans.

For nearly a century, before the introduction of real-time online listings, the Journal was the financial markets’ official newspaper.

It grew into a six-day-a-week weekly (available online since 1996). The Journal is an established and respected source of financial and business journalism.

The three founders worked out of offices in Lower Manhattan. The fact that they chose to name their new journal The Wall Street Journal suggests that Wall Street had already become somewhat of an umbrella phrase for the world of finance and its inhabitants. Over time, the paper helped to solidify this idea in the public’s consciousness.

1920 – Bombing

It was approximately midday on September 16, 1920. A horse-drawn cart arrived at 23 Wall Street, directly in front of the headquarters of J.P. Morgan & Co. It was a busy section of the neighborhood, especially with people heading out for lunch. The wagon immediately exploded It was loaded with explosives and filled with sash weights that sailed through the air.

At the time, it was the worst domestic bombing in American history. Ultimately, 40 individuals were murdered or died as a result of their injuries, with another 300 injured. The J.P. Morgan building’s interior was completely gutted. The shrapnel marks are still apparent on the outside.Nobody claimed credit, and the case was never solved. However, because the explosion occurred in front of the Morgan Building, a symbol of American capitalism, the bombing was eventually determined to have been an act of terrorism committed by “Reds”—anarchists and communist supporters A stack of anarchist flyers discovered in a mailbox a block from Wall Street confirmed this notion.

As a result, the authorities arrested hundreds of suspected Reds and deported individuals with foreign nationality. The bombing also fueled nativist attitudes that emerged in the United States during the 1920s, resulting in harsher immigration restrictions.

1929 – Financial Crises

The 1929 stock market crash remains the most severe financial catastrophe in US history. The NYSE served as the epicenter of trading prior to digitalization.

The crisis occurred on October 24, when, after nearly a decade of unprecedented, unbroken expansion, the stock market opened lower than the previous day. Equity prices continued to fall throughout the day, and as word spread, masses gathered outside the Exchange.

They grumbled when the market closed down again that day, cheered brokers for the next two days when the market appeared to rise, then panicked on October 28 and 29, when the falls returned. Inside the stock exchange, the sight was complete chaos, as values plunged too quickly for ticker tapes and blackboards to record them.Ultimately, the DJIA would plummet 89% from its September 1929 peak wiping out both corporate and personal wealth.

The crash triggered the Great Depression As the U.S. economy spiraled out of control, a quarter of the working population lost their employment. Economies across Europe followed suit. Finally, the stock market crash and the decade-long depression had a direct impact on practically every segment of society, changing an entire generation’s perception of and connection with financial markets.

Franklin D. Roosevelt Presidential Library and Museum, “Great Depression Facts.”

1987 – A Black Monday Morning Crash

On what became known as Black Monday, October 19, 1987, the S&P 500 Index and Dow Jones Industrial Average lost more than 25% of their value prompting exchanges around the world to follow suit. The week before, indices had plunged by around 10%, setting the stage for the subsequent panic. Until that point, a bull market had been in charge since 1982.

The actions of chairman Alan Greenspan and the Federal Reserve prevented a global tragedy. However, the crash highlighted the potential for disruption caused by the then-new technology of computer programs initiating large-scale volumes of trading (although massive amounts of trading were also handled by humans that day).The actual cause of this short-term crash has never been identified. However, exchanges then incorporated circuit breaker restrictions to prevent program trading from causing runaway selling. It was believed that this and other trading restrictions would give markets time to stabilize and regulators (and investors) the opportunity to take appropriate action.

1907 – The Panic of United State

The Panic of 1907, also known as the 1907 Bankers’ Panic or the Knickerbocker Crisis, was a financial crisis that occurred in the United States over a three-week period beginning in mid-October, when the New York Stock Exchange plunged about 50% from its peak the previous year.

The panic happened during an economic downturn, and there were numerous runs on banks and trust corporations. The 1907 panic gradually expanded across the country as numerous state and local banks and enterprises declared bankruptcy The principal causes of the run were a reduction in market liquidity by a number of New York City banks and a lack of trust among depositors worsened by unregulated side bets at bucket shops.The panic was prompted by a failed attempt in October 1907 to corner the market on United Copper Company stock. When the bid failed, banks that had given money to the cornering scheme experienced runs which expanded to affiliated banks and trusts, eventually bringing the Knickerbocker Trust Company, New York City’s third-largest trust, down a week later. The Knickerbocker’s failure fanned alarm throughout the city’s trusts, causing regional institutions to withdraw reserves from New York City banks. The panic subsequently spread across the country as a large number of consumers withdrew deposits from their regional banks, resulting in the eighth-largest fall in US stock market history.

The panic could have worsened if financier J. P. Morgan hadn’t intervened, pledging significant sums of his personal money and convincing other New York bankers to do the same to shore up the banking system. This exposed the inadequacies of the US Independent Treasury system, which oversaw the country’s money supply but was unable to restore sufficient liquidity to the market. By November, the financial contagion had largely subsided, only to be followed by a new crisis caused by a large brokerage firm’s significant borrowing with Tennessee Coal, Iron, and Railroad Company (TC&I) stock as security.

The collapse of TC&I’s stock price was prevented by an emergency takeover by Morgan’s U.S. Steel Corporation, which was allowed by President Theodore Roosevelt, who opposed trusts. The next year, Senator Nelson W. Aldrich, a major Republican, formed and chaired a commission to analyze the situation and recommend future solutions, which resulted in the establishment of the Federal Reserve System.

2007 The Global Financial Crisis

The 2007-2008 global financial crisis was caused by years of deregulation, easy credit, predatory mortgage lending, the collapse of the subprime mortgage market, and the unregulated use of derivatives. It contributed to the Great Recession. The crisis was caused by banks, investment banks, and insurance companies engaging in unethical and predatory activity.

Borrowers with poor credit were granted mortgage loans without regard for their ability to repay them and without understanding the dangers associated with the loans. As rates rose those borrowers’ mortgage rates reset higher, leaving them unable to make monthly payments. Furthermore, as property prices plummeted substantially, homeowners were unable to sell their properties for enough to cover their mortgages. This resulted in a tremendous number of defaults.

Banks issued subprime mortgage loans, which resulted in the creation of risky derivative products. Banks and other large investors also invested in these derivatives using consumer deposits. The value of derivatives plummeted as home loan defaults increased.

Many financial institutions were involved in loans, derivatives, and credit default swaps, which are insurance products purchased by derivatives investors to protect against the risk of default. As a result, they found themselves in deep problems after the housing market bubble burst.

From the housing market meltdown to a US banking industry on the verge of collapse, to the near-destruction of other financial institutions throughout the world. It was the most severe financial crisis since the stock market crash of 1929.

The US government had no choice but to bail out financial firms that had long been regarded as “too big to fail.”

2011 – Occupy The Exchange

Occupy Wall Street was a 2011 protest movement against social and economic injustice centered on Zuccotti Park in Manhattan’s Financial District It began on September 17 when hundreds of demonstrators camped out in the park.

Two months later, on November 15, the police violently removed and detained them. During the interim, there were marches and speeches advocating for more equitable income distribution, higher-paying jobs, bank reform, and less corporate influence in government. “We are the 99%,” was the Occupy protesters’ motto.

Regulation of Wall Street

Following the 1929 Crash

Regulatory measures were implemented to remedy the absence of government monitoring, which was thought to have contributed to the 1929 crisis. Among other things the Securities Act of 1933 mandated financial institutions to furnish investors with all relevant information regarding securities offered for sale. It also outlawed securities fraud.

The Securities Exchange Act of 1934 established the Securities and Exchange Commission (SEC) which had tremendous control over the securities industry. This included the authority to supervise brokerage firms and compel financial reporting from publicly traded enterprises.

After the 2007-2008 Financial Crisis

In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act It established new government agencies responsible for overseeing the financial system.

The measure was intended to address financial institution’s risky behaviour and a lack of regulatory monitoring that contributed to the crisis One source of serious concern was the predatory mortgage lending that had happened. Another priority was the stability of financial institutions. The act made it feasible to dissolve or restructure businesses if required, in order to avoid the need of taxpayer cash to keep them going.

The Volker Rule, enacted by the act, limited bank investing practices and governed derivative securities. It also established the SEC Office of Credit Ratings to ensure that credit agencies issued acceptable ratings for banks in the future, rather than the faked good ratings that existed prior to the crisis.

Dodd-Frank Act

- Purpose: The Dodd-Frank Act aimed to prevent a similar crisis by making the U.S. financial system safer for consumers and taxpayers.

- Sponsors: Named after Sen. Christopher J. Dodd (D-Conn.) and Rep. Barney Frank (D-Mass.), it contains numerous provisions spread across 848 pages.

- Targeted Sectors: The act addressed banks, insurance companies, investment firms, mortgage lenders, and credit rating agencies.

- Government Agencies: It established new agencies to oversee various aspects of the financial system.

Criticism

- Some argue that the regulatory burdens imposed by Dodd-Frank could make U.S. firms less competitive globally.

- In 2018, Congress rolled back some of Dodd-Frank’s restrictions.

Throughout the Trump Administration

The Economic Growth, Regulatory Relief, and Consumer Protection Act, signed into law by President Trump in 2018, addressed Dodd-Frank critiques and repealed some components.

Among other things, it exempted banks with assets of less than $10 billion from the Volker Rule requirements, allowed individuals to freeze their credit files for free, and reduced capital requirements for institutions that did not provide lending or traditional banking services.

Importance of Wall Street

- Global Impact:

- As the trading hub for the world’s largest economy, Wall Street has an oversized influence on the global financial system.

- Securities markets are sensitive to changes in the economic climate, making Wall Street a bellwether for the entire economy.

- Financial Industry Hub:

- Wall Street encompasses various entities: investment banks, commercial banks, hedge funds, mutual funds, asset management firms, insurance companies, broker-dealers, and more.

- While some of these entities have headquarters in other cities, the media still refers to the U.S. investment and financial industry as Wall Street.

- Symbolic Importance:

- Wall Street symbolizes both economic prowess and cultural significance.

- It houses major financial institutions, including the Federal Reserve and the New York Stock Exchange.

What is black wall street

Black Wall Street was a nickname given to the Greenwood District of Tulsa, Oklahoma, one of the largest and most wealthy African-American commercial districts in the United States in the early 1900s. During the Tulsa Race Riot in May and June of 1921, 35 of its blocks were demolished. It was soon repaired, and over 80 companies had reopened by 1922. More broadly, Black Wall Street can refer to any region where African Americans engage in significant commercial or financial activity.

Related – How to Invest in the US Stock Market in 2024

The Origins of Black Wall Street

In the early 1900s, communities such as Hayti in Durham, Bronzeville in Chicago, Sweet Auburn in Atlanta, West Ninth Street in Little Rock, Arkansas, Farish Street in Jackson, Mississippi, and Jackson Ward in Richmond, Virginia, were among the most prosperous African American communities in the country, with thriving business and economic development ecosystems.

The Greenwood district in Tulsa, Oklahoma, may be the most well-known of the Black Wall Street communities.

Booker T. Washington, the founder of the Tuskegee Institute in Tuskegee, Alabama, dubbed Greenwood “Negro Wall Street” because of the great concentration of Black professionals—doctors, lawyers, business owners, and others—on just 40 square blocks.2 Fueled by the oil boom and Washington’s pronouncement, Black individuals and families from throughout the country traveled to Tulsa and collaborated to start businesses and raise funds to develop a self-sufficient, wealthy community.

Although racial segregation was the norm in post-Civil War America, Black Wall Street reversed the trend, allowing aspiring Black entrepreneurs to offer goods and services to their own neighbors because many white-owned firms refused to serve Black communities or customers.

African Americans established their own insurance companies, banks, funeral homes, grocery stores, medical clinics, and other businesses to address the needs of their neighbors. These enterprises not only provided goods and services, but also employed members of the community.

Churches, movie theaters, restaurants, nightclubs, hotels, and other meeting places sprouted up to service the rising populations of Black Wall Street, as more people had money to spend.

What companies are in Wall Street?

FundGuard

Founded 2018

Founded 2018

USA

USA

Ripple (fka OpenCoin)

Privately Held

Privately Held

Founded 2012

Founded 2012

USA

USA

Betterment

Privately Held

Privately Held

Founded 2008

Founded 2008

USA

USA

Puck

Privately Held

Privately Held

Founded date unknown

Founded date unknown

USA

USA

d1g1t

Privately Held

Privately Held

Founded 2017

Founded 2017

Canada

Canada

SeatGeek

Privately Held

Privately Held

Founded 2009

Founded 2009

USA

USA

Novig

Privately Held

Privately Held

Founded 2021

Founded 2021

USA

USA

Aero Farm Systems

Privately Held

Privately Held

Founded 2004

Founded 2004

USA

USA

TruMid Financial

Privately Held

Privately Held

Founded 2014

Founded 2014

USA

USA

Newsguard Technologies, Inc.

n/a

n/a

Founded 2018

Founded 2018

USA

USA

Quantum Xchange

Privately Held

Privately Held

Founded 2018

Founded 2018

USA

USA

Smartling

Privately Held

Privately Held

Founded 2009

Founded 2009

USA

USA

CircleUp

Privately Held

Privately Held

Founded 2012

Founded 2012

USA

USA

Apptimize

Privately Held

Privately Held

Founded 2013

Founded 2013

USA

USA

Indiegogo

Privately Held

Privately Held

Founded 2008

Founded 2008

USA

USA

Ellevest

Privately Held

Privately Held

Founded 2014

Founded 2014

USA

USA

WorkFusion

Privately Held

Privately Held

Founded 2010

Founded 2010

USA

USA

Expensify

Privately Held

Privately Held

Founded 2008

Founded 2008

USA

USA

Mosaic

Privately Held

Privately Held

Founded 2011

Founded 2011

USA

USA

Nektar Therapeutics

Publicly Traded

Publicly Traded

Founded 1990

Founded 1990

USA

USA

Thinknum

Privately Held

Privately Held

Founded 2014

Founded 2014

USA

USA

What is Wall Street famous for?

Wall roadway is a roadway in New York City’s Financial District, namely in Lower Manhattan. It spans eight city blocks from Broadway in the west to South Street and the East River in the east1. Figuratively, Wall Street signifies much more than simply a geographical location; it is synonymous with the financial industry and the organizations that comprise it. Historically, several brokerage firms and investment banks placed their offices on or near Wall Street in order to be proximate to the New York Stock Exchange (NYSE). While being on or near Wall Street is no longer required for financial institutions, the word “Wall Street” nevertheless refers to the investing industry and the interests of its participants. Events on or near Wall Street frequently affect not just the investment industry but also the U.S. and global economy

What does Wall Street actually do?

The term “Wall Street” refers to the major investment firms, banks, and brokerages in the United States, many of which are based in lower Manhattan’s financial area. Many of these firms make money by recognizing and investing in companies that are expected to increase in value.

What are Wall Street simple terms?

Proper noun. Wall roadway is a roadway in New York that houses the Stock Exchange and other financial institutions. The term “Wall Street” is frequently used to refer to both the financial transactions that take place there and the individuals who work there.

Who owns Wall Street?

The WSJ is a division of Dow Jones, which is owned by Rupert Murdoch’s News Corp.

Who is the CEO of Wall Street?

Almar Latour is Publisher of The Wall Street Journal and CEO of Dow Jones, a world-leading news and business information services company.

How Do You Get a Job on Wall Street?

Getting a job on Wall Street typically begins in college. Majors in finance, business administration and management, economics, accounting, and mathematics are ideal for the investing industry. Firms will also examine degrees in other fields, such as marketing and engineering. Attempt to secure an internship with a Wall Street firm or equivalent institution for at least one summer. A Master of Business Administration (MBA) degree as well as experience in the technology business may appeal to financial institutions It’s also critical to determine what type of Wall Street career you’re most suited for. They divide into three major areas

The investment team includes research analysts, portfolio managers, and traders.

Operations include client interactions, marketing, risk assessment, legal, and back-office operations.

Salespeople are those who create, promote, and sale of stocks, bonds, IPOs, foreign exchange, and other financial instruments

Who is known as the King of Wall Street?

Its CEO and chairman at that time, John Gutfreund, was nicknamed “the King of Wall Street”. Salomon Brothers, Inc.

Becky Scott is a seasoned finance journalist specializing in providing expert guidance on financial news and trends. With a career dedicated to demystifying complex economic topics, Becky offers clear and insightful analysis that empowers readers to navigate the world of finance with confidence. Her articles are known for their practical advice and thorough research, aimed at helping individuals and businesses make informed financial decisions. Becky Scott’s passion for financial literacy is evident in her commitment to delivering accurate and accessible information that resonates with a wide audience.