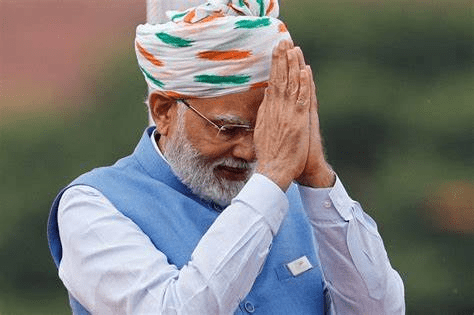

The Wall Street – Welcome to our financial insights series! In today’s episode, we dive deep into the seismic shifts caused by Prime Minister Narendra Modi’s recent election win in India. Join us as we explore the benefits, challenges, and emerging trends.

Bharti Janta Party (BJP) Won the 2024 Indian general Election by 270 Seats

1. Benefits of the BJP Government

Investment in Manufacturing

The Modi administration has actively encouraged foreign investment in Indian industry India has grown in popularity as businesses look to diversify their supply networks away from China This change may have a favourable effect on Indian stocks and attract international capital

Enhancements to the Infrastructure

Under Modi’s direction India’s digital and physical infrastructure has significantly improved Improved infrastructure can draw in investors increase economic growth and improve corporate efficiency.

Read this – The US Economy Crash: Turning Wall Street to the upside.

2. Challenges

Soaring Crude Oil Prices

Even if Modi’s victory is usually good for the markets, problems still exist. A worry is the recent increase in the price of crude oil.

Increased oil prices may affect Wall Street and other international markets as well as India’s economy.

Wall Street Analysis Report

3. Emerging Trends

Sustained Economic Development

India’s economy expanded by more than 8% in the fiscal year that ended in March solidifying its position as the world’s fastest-growing major economy. This growth trend could continue benefiting both domestic and international investors.

Market Optimism

Exit polls indicate a resounding victory for Modi leading to optimism in Indian markets. The benchmark Sensex index and the broader Nifty 50 index have already reached all-time highs reflecting investor confidence

4. Market Reactions

a. Immediate Impact

- Stocks: Expect initial volatility as investors digest the news The US stock market may experience fluctuations, especially in sectors with exposure to India or global emerging markets.

- Bonds: Bond yields could react to geopolitical uncertainty, affecting interest rates and investor sentiment.

- Currency: The Indian rupee’s depreciation may impact global currency markets, including the US dollar.

b. Long-Term Implications

- Trade Relations: The new Indian government’s policies will influence trade relations with the US. Companies with significant India-US trade ties may see stock price movements.

- Sector-Specific Effects: Keep an eye on sectors like technology, pharmaceuticals and energy which have strong India-US connections.

3. Key US Stocks to Watch

While it’s challenging to predict precise outcomes here are some major US stocks that could be affected:

a. Tech Giants

- Google (Alphabet): Google has a substantial presence in India, including Android adoption and digital advertising. Any regulatory changes could impact its revenue.

- Microsoft: India is a critical market for Microsoft’s cloud services. Political shifts may affect business prospects.

b. Pharma and Healthcare

- Pfizer: India is a significant market for pharmaceutical companies Regulatory changes could impact drug approvals and sales.

- Johnson & Johnson: Similar to Pfizer J&J has a substantial Indian presence.

c. Energy and Infrastructure

- ExxonMobil: India’s energy demand affects global oil prices Political instability may impact energy stocks.

- General Electric: Infrastructure projects in India could impact GE’s business.

Conclusion

Modi’s resounding victory in the state elections has bolstered positive feelings in India. Wall Street is keeping a careful eye on the events developing and investors need to be aware of the possible effects of Modi’s policies on international markets. Recall that investing has dangers and getting expert counsel is crucial.

Disclaimer: This blog post provides general information and does not constitute financial advice. Always conduct your research and consult professionals before making investment decisions. The Wall Street

Becky Scott is a seasoned finance journalist specializing in providing expert guidance on financial news and trends. With a career dedicated to demystifying complex economic topics, Becky offers clear and insightful analysis that empowers readers to navigate the world of finance with confidence. Her articles are known for their practical advice and thorough research, aimed at helping individuals and businesses make informed financial decisions. Becky Scott’s passion for financial literacy is evident in her commitment to delivering accurate and accessible information that resonates with a wide audience.