Wall Street is having problems getting ‘too positive’ about the United States- US economy.

Economic consensus has switched from forecasts chasing the data higher to lower levels of optimism as recent data indicate activity cooling across a variety of indicators.

This has dashed optimism that economic growth may suddenly accelerate for the second consecutive year.

“I am having trouble getting too excited about the economy,” Renaissance Macro’s head of economic research, Neil Dutta, said in a note to clients Monday.

“Conditions are fine, but I would hardly describe the situation as consistent with a meaningful acceleration.”

Goldman Sachs’ economics research team, chaired by Jan Hatzius, has been among the most optimistic about the economy’s prospects during the last year. However, the business reduced its forecast for second-quarter GDP to an annualized growth rate of 2.7% from 3.2% on May 24 due to “weak spending momentum to start the quarter.”

Similarly, the Atlanta Fed’s GDPNow tracker, which analyzes data inputs from throughout the quarter to estimate how GDP is pacing, has dropped to 1.8% from above 4% at the start of May.

The Wall Street Report

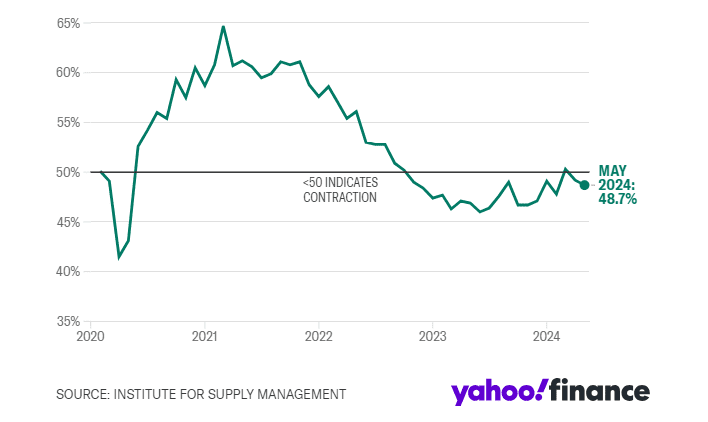

Following the publication of a new report on industrial activity by the Institute for Supply Management (ISM), which showed a notable decline in activity last month, Dutta made his announcement on Monday.

Bloomberg statistics show that the ISM’s manufacturing PMI came in at 48.7 in May, down from a score of 49.2, which was below the 49.5 economists had forecast.

After entering growth territory in March and surpassing 50 for the first time since 2022, the indicator has declined for the last two months.

As per Yahoo Finance Report – “The drop in the ISM manufacturing index in May adds to the sense that the economy is losing momentum,” Capital Economics North America economist Thomas Ryan wrote in a note to clients.

MANUFACTURING INDEX FALLS FOR A SECOND CONSECUTIVE MONTH

U.S. ISM Manufacturing PMI since February 2020

The most recent weaker-than-expected economic data point is the decline in PMIs.

Early in May, the US jobs data for April revealed that job creation was less robust than anticipated and that the unemployment rate had unexpectedly increased. This data was followed by a less optimistic reading on retail sales in April.

Reduced consumption was a major factor in the second estimate of first quarter GDP growth’s drop in late May.

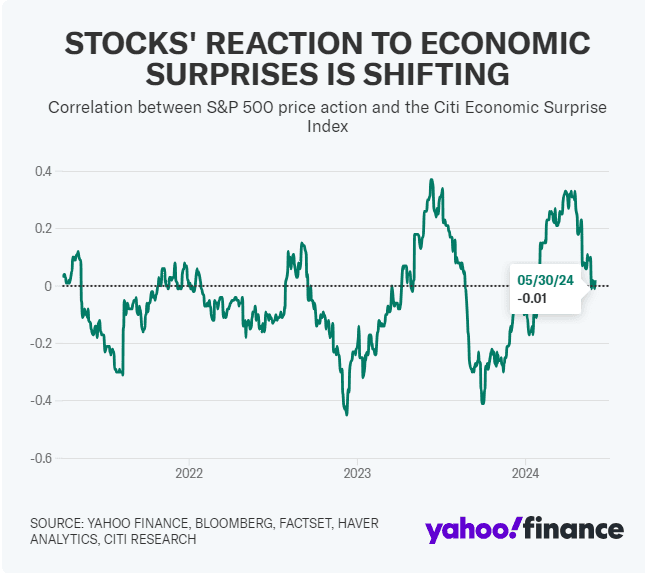

With all three of the major indices reaching all-time highs in May the stock market has shown no symptoms of weakness.

The S&P 500 and the Citi Economic Surprise index have been correlated less and less, indicating that stock investors are starting to view unfavourable economic news as positive for the market.

Many believe that rather than indicating a clear decline in economic activity, the current economic data is paving the way for interest rate reductions by the Federal Reserve. Even with lower rates and slower growth, equities may benefit from the current climate.

For example, the S&P 500 gained almost 1.3% after the poor April jobs report.

Ohsung Kwon, the US and Canadian equities strategist at Bank of America, noted in a note on Monday that it will be important to see if economic growth continues to decline since “bad news can turn into bad news” for stocks as well.

The release of the May jobs report on Friday will be the next litmus test for this storyline.

According to data from Bloomberg, the report is anticipated to reveal that 185,000 nonfarm payroll jobs were added to the US economy last month, while the unemployment rate remained at 3.9%.

“Stronger growth should also be positive for stocks,” Kwon said.

According to Kwon, a reading like this would maintain the labor market tracking in the “Goldilocks” region, which is neither too hot nor too cold to exacerbate concerns about sticky inflation or a downturn. Many Wall Street experts believe that if the slowing economy turns out to be a head fake, equities might still rise because inflation is still trending lower. “Stronger growth should also be positive for stocks,” Kwon stated.

Read More

Indian Election Update 2024: Results and Impact on the US Market

Becky Scott is a seasoned finance journalist specializing in providing expert guidance on financial news and trends. With a career dedicated to demystifying complex economic topics, Becky offers clear and insightful analysis that empowers readers to navigate the world of finance with confidence. Her articles are known for their practical advice and thorough research, aimed at helping individuals and businesses make informed financial decisions. Becky Scott’s passion for financial literacy is evident in her commitment to delivering accurate and accessible information that resonates with a wide audience.