A Chase business card is a credit card created exclusively for business use, including features such as rewards on business spending, cost management tools, and business-specific incentives like travel rewards or cash back. It assists businesses in managing spending, building credit, and earning rewards based on their needs.

Applying for a Chase business card is straightforward. Here’s a step-by-step guide to help you

Eligibility Check: – Determine your eligibility prior to applying. Factors include the revenue, credit history, and legal structure of your company. Corporations, LLCs, partnerships, and sole owners are all eligible to apply. Gig workers and freelancers may also be eligible. An Employer Identification Number (EIN), which you can get online via the IRS1 may be required.

Choose the Right Card: – Examine the various kinds of company credit cards available. Think about travel rewards cards (for hotels, flights, etc.), cash back cards (redeemable as statement credits), and cards tailored to a particular business. Extras like airport lounge access and annual fees are important.

How to apply for Chase business card

- Application Process:

- Personal Information: Start by providing your personal details.

- Business Information: Next, share your business name, address, tax ID, annual revenue, and years in business.

- Employee Cards: Decide if you want additional employee cards.

- Billing Statement Preferences: Choose how you’d like to receive billing statements.

Chase offers several business credit cards, each with unique features. Here are some popular options:

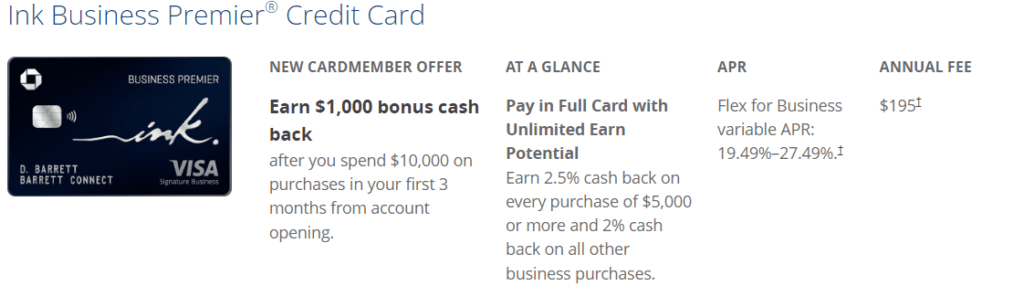

Chase Ink Business Premier® Credit Card:

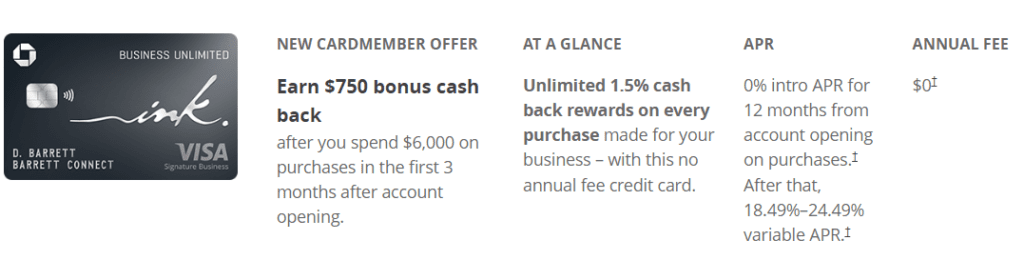

Chase Ink Business Unlimited® Credit Card:

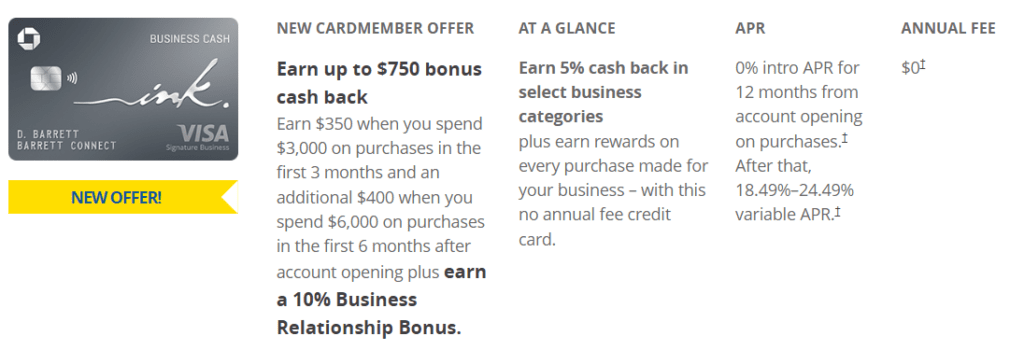

Chase Ink Business Cash® Credit Card:

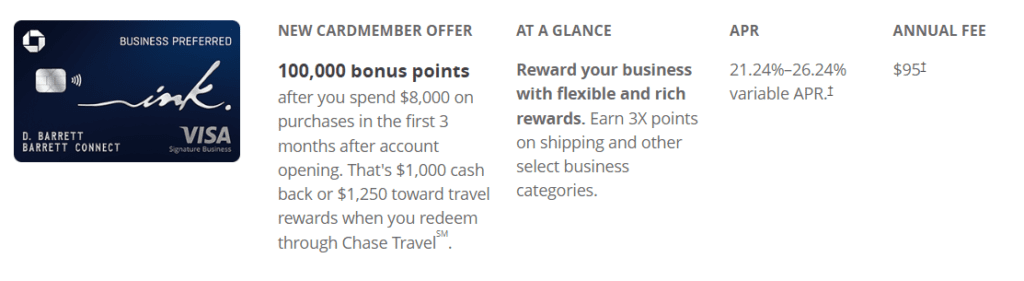

Chase Ink Business Preferred® Credit Card:

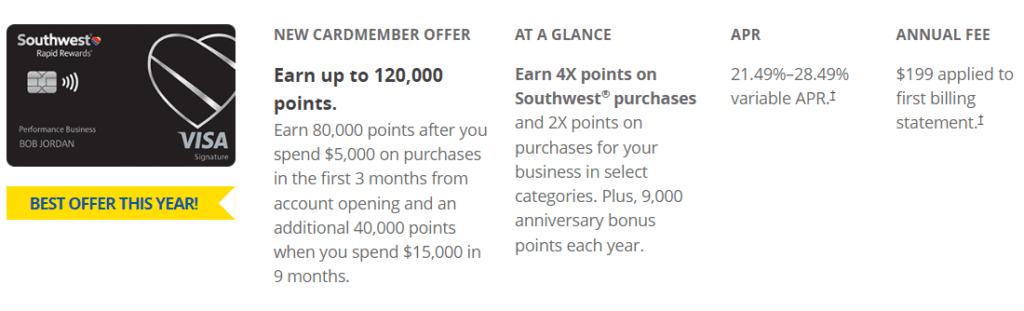

Southwest Rapid Rewards® Performance Business Credit Card

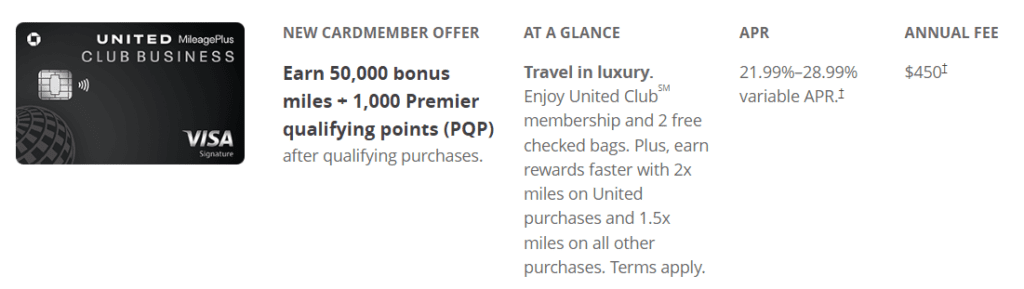

United ClubSM Business Card

Following Eligibility Criteria:

- Legal Structure and Revenue:

- Sole proprietors, partnerships, LLCs, and corporations can apply.

- No specific operational or financial requirements.

- Even brand-new businesses may be eligible.

- Documentation:

- Ensure your business is properly registered.

- Gather the necessary documentation to support your application.

- Tax ID (EIN):

- Some cases may require an Employer Identification Number (EIN).

- Apply for an EIN online through the IRS if needed.

How to redeem Chase business card points

- Cash Back:

- Log in to your Chase account online or through the app.

- Navigate to the rewards section and review your available balance.

- Redeem your points for cash back at a rate of $1.00 per 100 points (1 cent per point).

- Choose either a statement credit or direct deposit.

- Travel:

- Use the Chase Ultimate Rewards portal to book travel.

- Points are worth 25% more when redeemed for travel.

- For example, 20,000 points are worth $250 toward travel.

- You can use your credit card, points, or both to book your trip online.

Disclaimer

The information provided in this blog post is for educational and informational purposes only. It does not constitute financial, legal, or professional advice. Always consult with a qualified professional before making any financial decisions.

Chase Business card – official site click here

Read more

What is the fine for EU competition?

Becky Scott is a seasoned finance journalist specializing in providing expert guidance on financial news and trends. With a career dedicated to demystifying complex economic topics, Becky offers clear and insightful analysis that empowers readers to navigate the world of finance with confidence. Her articles are known for their practical advice and thorough research, aimed at helping individuals and businesses make informed financial decisions. Becky Scott’s passion for financial literacy is evident in her commitment to delivering accurate and accessible information that resonates with a wide audience.