The Wall Street – The current interest rate environment is favourable for retirees and those approaching retirement.

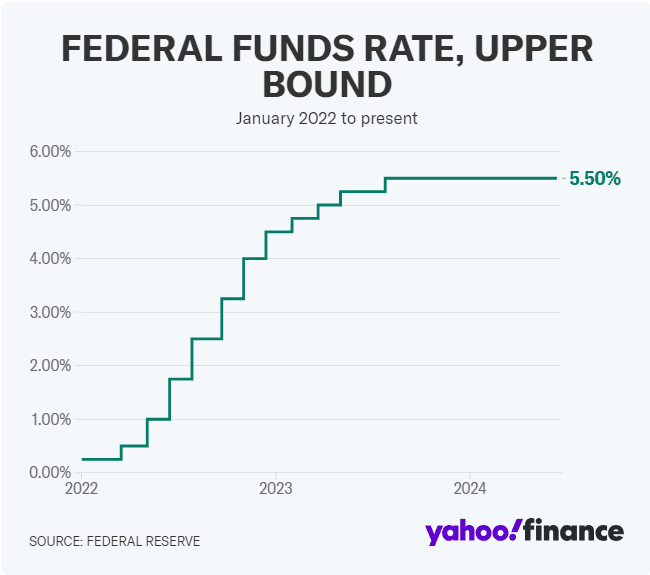

Interest rates will remain high in 2024. The Federal Reserve kept interest rates at a 23-year high this week while cutting its forecast for rate cuts this year from three to one.

High interest rates are clearly good news for short-term savers, “with the top yields on savings accounts, money markets, and CDs handily outpacing the rate of inflation,” Greg McBride, chief financial analyst at Bankrate.com, told Yahoo Finance.

“These rates should remain above the inflation rate for at least the next year, making them ideal for an emergency fund or any savings intended for short-term goals or expenses,” said Ken Tumin, a senior industry analyst at LendingTree.

However, the current rate situation is considerably more favourable for retirees and those approaching retirement. I spoke with numerous wealth management professionals to better understand how those groups should make investing decisions

Choose high-rate Rate Plans

Retirees sometimes fail to save away enough funds to cover living expenses for a year or two following retirement. There is no better time than now to save money in low-risk fixed-income instruments like Treasury securities and CDs.

One simple method to accomplish this is to deduct some of the earnings from your equities assets in retirement and non-retirement accounts which have been on a tear this year. The S&P 500 index (GSPC) has risen by more than 24% in the last year.

“When you reach retirement and begin withdrawing money from your investment and retirement accounts, and markets take a turn for the worse retirees may find themselves in a position where they are selling their investments that are decreasing in value to raise the cash that they require,” Jake Sadler, founder and senior adviser at Curio Wealth in Annapolis, Md., told Yahoo Finance.

“If this goes on for too long, especially at the beginning of retirement, it can permanently reduce the odds that your money will last for your lifetime,” he stated.

One method, particularly for those nearing retirement, is to “build a ‘risk-free’ buffer of cash using

high-yield CDs and money market accounts with higher rates now that you can draw from if markets start working against you in the first years of retirement,” he explained.

Discover more about high-yield savings, money market, and CD accounts.

The most ‘alluring’ possibilities

Some certificates of deposit and high-yield savings accounts currently offer rates above 5%. The most appealing CD rates, offered primarily by internet banks, were recently at 5.65% for a one-year certificate.

“These provide retirees a valuable opportunity to keep pace with inflation while keeping cash accessible,” Michael A. Scarpati, founder and CEO of RetireUS, told Yahoo Finance.

While most bond funds have the same yields as savings and money markets, they carry additional risk and are not FDIC guaranteed. m

“In this context of high interest rates and uncertainty, high-yield cash investments are on the rise. “There’s no reason to take on additional risk when we can get the same returns in cash positions while maintaining peace of mind,” he said.

Keep investing in equities

Higher interest rates on CDs and money markets are to be celebrated, but long-term stock returns remain a more important aspect in your financial stability when considering your lifespan. When it comes to retirement planning, most people overlook the importance of longevity.

It can be difficult to save enough money to live in retirement for three decades or more. Soaring costs for everything from groceries to healthcare and home insurance have further exacerbated the problem.

According to a recent survey conducted by investment management Schroders, nearly half of all retirees estimate that their retirement expenses are more than they expected, and around half assume Medicare would cover more of their healthcare expenses.

Owning equities is important for many retirees, even decades after they leave the working. The prospect of living beyond 100 emphasizes the importance of having some longer-term growth boosting your investment returns.

The typical advise today is to subtract 125 from your age (it used to be 110), and that is the percentage of your retirement assets that should be put in stocks. For example, a 65-year-old with a moderate risk tolerance could have up to 60% of her retirement account invested in equities.

This is to take advantage of the long-term upside potential growth that stocks often provide when contrasted to fixed-rate options like bonds, money markets, or CDs.

If you truly want to keep it simple, you might do as Jordan Belfort, author of “The Wolf of Investing,” instructed me. Stick with an S&P 500 index fund, which is up 10.99% this year and has gained approximately 10.7% on average annually since It was introduced in 1957.

The Benefits of T-bills

Another advantage of the Fed maintaining higher interest rates is that all savers looking for a secure investment for a year or less can still obtain the best yields in years from Treasury bills or T-bills, which are short-term securities issued by the federal government. On June 12, the one-year T-bill rate was 5.13%, while the six-month T-bill was 5.38%. The three-month T-bill yielded 5.25% on June 11.

As long as the Federal Reserve keeps interest rates high, short-term investments in T-bills provide reasonable returns while also saving money on state and local taxes.

“T-bill yields remain higher than most online savings accounts and short-term CD yields and the tax benefit is key,” Tumin stated.

You can purchase newly issued Treasury securities in terms ranging from four to 52 weeks through your bank or brokerage, which may charge a commission.

You can also buy them online for a minimum of $100 using the government’s TreasuryDirect program, which has no commission.

There is no risk of losing money

A side benefit of transferring some of your assets to cash accounts is that you will be prepared for large-ticket expenses that frequently occur after retirement.

“The first phase of retirement can be an exciting time” Sadler stated. “This phase often comes with a feeling of delayed gratification, and large expenses are very common during this time — think travel, new car, renovations, and celebrations.”

Cash is an excellent place to store if you know you’ll need it in the next 1 to 5 years according to him. “There is no risk of losing money, and with higher rates you can earn more on what you save during that time.”

One caveat: Even when interest rates fall, your motivations for holding cash may not change. “If saving more in cash serves a specific purpose, then honor that purpose,” Sadler advised.

“Safety is often far more important than yield when it comes right down to it.”

Read more

Dow Jones Futures Fall: Tesla shareholders approved a massive pay deal for Elon Musk

Becky Scott is a seasoned finance journalist specializing in providing expert guidance on financial news and trends. With a career dedicated to demystifying complex economic topics, Becky offers clear and insightful analysis that empowers readers to navigate the world of finance with confidence. Her articles are known for their practical advice and thorough research, aimed at helping individuals and businesses make informed financial decisions. Becky Scott’s passion for financial literacy is evident in her commitment to delivering accurate and accessible information that resonates with a wide audience.