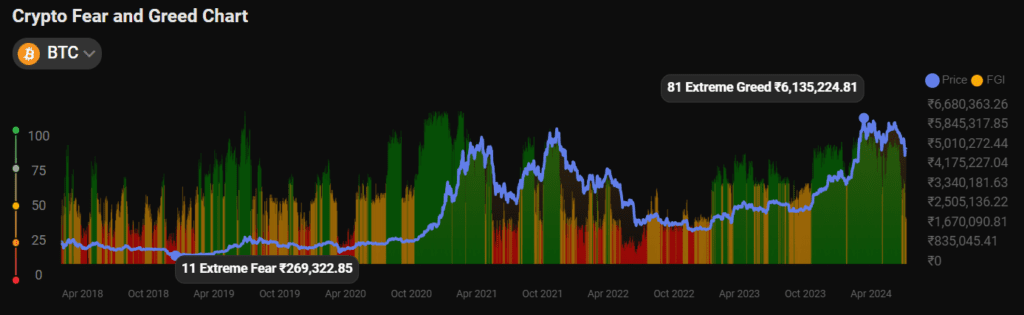

This is important to consult various charts and analytic sources, such as the Crypto Fear and Greed Index. The cryptocurrency markets are notorious for their constant high volatility.

It’s challenging to stay on top of this sector on your own due to the constant flow of news, fresh advancements, and shifting viewpoints.

Crypto Fear and Greed Chart

What is a Fear and Greed Index?

If you use popular cryptocurrency trading sites like Binance, Kraken, or Coinbase, a fear and greed index may sound familiar. It is a form of chart that is specifically created to represent the activities and emotions that are now propelling a market.

This is generally represented by a half-wheel and an arrow, with one side indicating whether the market appears to be driven by fear and the other by greed. Fear and greed indexes, both traditional and crypto, are widely used for market analysis.

A cryptocurrency fear and greed index differs from other charts and graphs found on exchanges. It does not track the price of an asset or the quantity bought or sold, but rather records a live emotion in the crypto space, assessing how people are behaving and feeling about the business.

If people are concerned about the future of the cryptocurrency market and expect adverse market swings, the index will indicate worry. However, if consumers expect price increases and are optimistic about the market, the index will indicate greed. If it is in the middle it may reflect neutral thinking or misunderstanding among traders.

This metric may appear juvenile or weird, yet it can be extremely useful in contextualizing the types of actions observed in the sector. It can also help to determine whether you, as a trader, should be concerned or not.

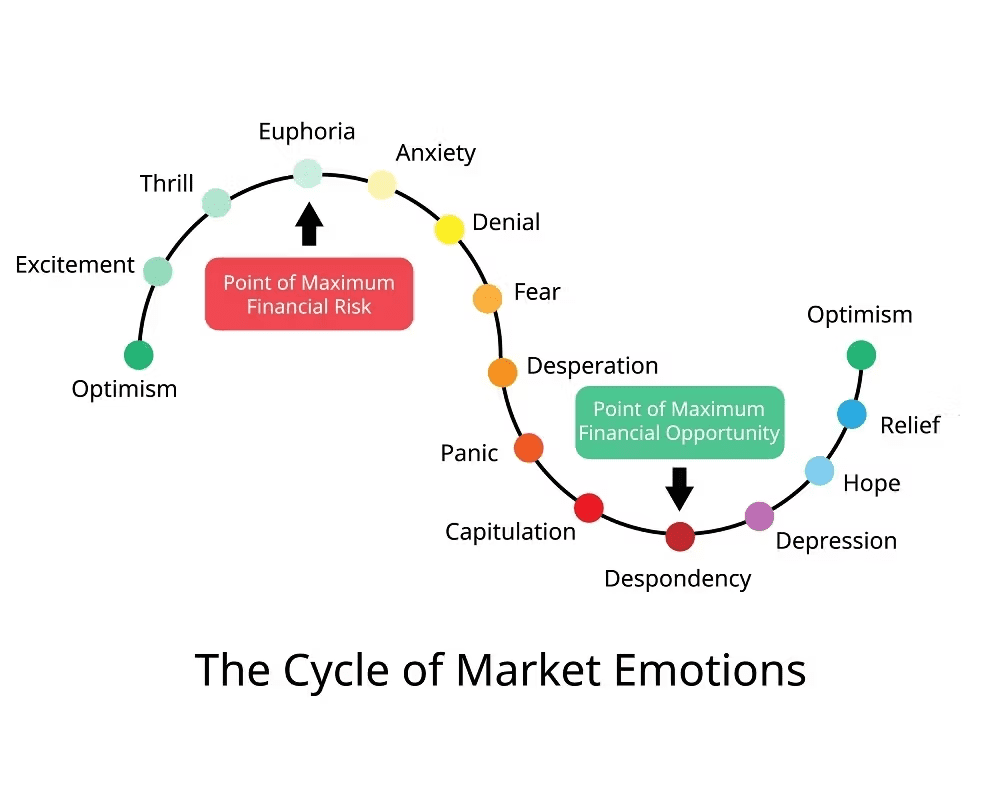

Some people utilize crypto fear and greed indices to compare their personal beliefs to those of the trading community, and then use that information to make informed decisions for themselves. Remember that, despite appearances, the financial markets are impacted by emotion, and the emotions of those engaged should be taken into account, as they can have an impact on asset performance.

There is no formal or fully established method for utilizing a crypto fear and greed index, as people incorporate them into their plans in varying ways. Some people follow the current crypto sentiment and act as if everyone else is doing the same, while others strive to go the opposite way.

Warren Buffett a trading legend and a significant figure in the fear and greed debate, has stated that people should “be fearful when others are greedy and greedy when others are fearful” implying a backward reading of the index.

In reality, this type of measure is very interpretable, therefore there are no hard guidelines for how to apply it. However, this does not make it any less or more essential than other methods of technical analysis, as they contribute to capturing the social temperature of the crypto trading landscape, particularly Bitcoin mood, as markets frequently follow Bitcoin’s moves.

What is Fear?

We must first define fear and greed exactly in order to understand how bitcoin fear and greed indexes work. Begin with fear. When traders are anxious about the market’s direction they feel this feeling. They are concerned about the current state of the market.

Several factors can cause this emotion to surface. It could be due to negative headlines, regulatory worries, or indicators of poor performance in technical analysis. This might manifest as traders avoiding riskier bets or even adopting a herd mentality by imitating the market movements of people around them due to a lack of confidence in their own capacity to make deductive and analytical decisions.

When our Bitdegree crypto fear and greed indicator falls below 50, it indicates a fearful market attitude. Anything under 20 indicates serious dread.

What is Greed?

Greed is the opposite of fear; it is the emotional response that arises when traders are not only confident but thrilled about the market. This causes individuals to place riskier bets, cling onto their assets for longer periods of time than usual, and act as if each day will bring larger gains and profits than the last. For our Bitdegree crypto fear and greed index, any score above 50 indicates some kind of market greed, while anything above 80 indicates severe greed.

How is the Whole Index Calculated?

The crypto fear and greed index is structurally similar to CNNMoney’s fear and greed index, which means it receives very similar types of information and produces comparable results but with an emphasis on real crypto and Bitcoin sentiment rather than traditional markets.

The information will be utilized in a way that produces the most accurate and meaningful results possible. The index’s goal is to give our users a competitive advantage in the trading world while also providing relevant insights.

Read more

Tao Crypto Coin: Everything You Need to Know Before Investing

What is a crypto fear and greed index?

A crypto fear and greed index is a visual chart that displays the current crypto feelings on the market among cryptocurrency traders and investors. The index is most usually represented as a half-wheel, with an arrow pointing to a certain region that indicates whether the market is in a positive (greed) or negative (fear) position.

What is the highest crypto fear and greed index?

The crypto fear and greed score can reach 100, indicating excessive greed – in other words, people are likely quite positive on Bitcoin and believe that other cryptocurrencies will also climb in price. In contrast, the lowest possible value is zero, which shows significant market anxiety.

How does a crypto fear and greed index work?

Crypto fear and greed index charts are calculated using a few specific parameters. While different indexes use different criteria, some common ones include market momentum and volatility, social signals, BTC dominance, specific Bitcoin feelings, and so on. Any positive or negative change in these metrics would cause the arrow on the index to shift to the appropriate side.

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.