The technical indicators did not suggest a near-term gain in the AVAX. The prolonged selling pressure over the past six weeks makes a drop to $30 more likely.

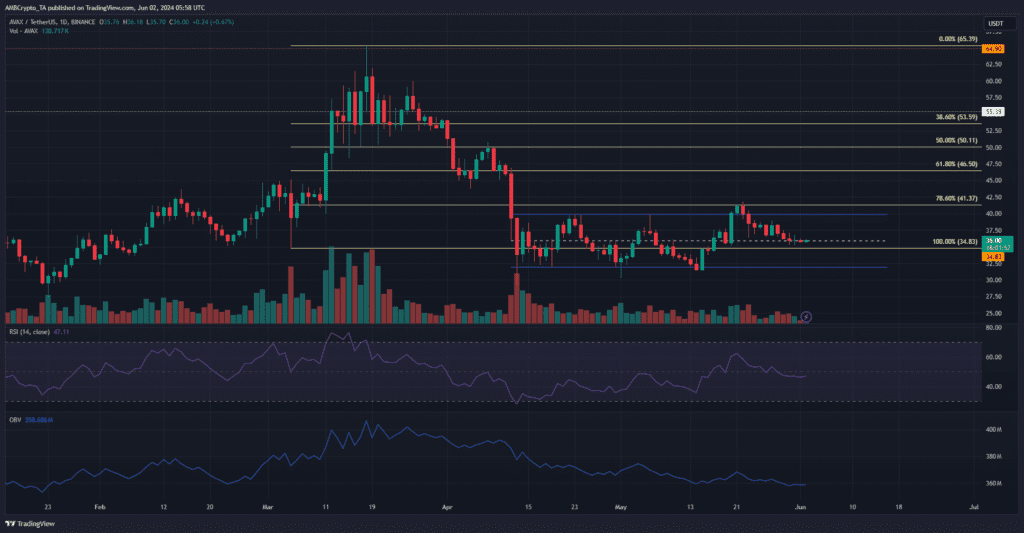

Since mid-April, AVAX has been between $39.9 and $36.1. The mid-range level, represented by the dotted white line at $35.9, is significant in the medium term. The bulls were on the verge of ceding power to the bears at the time of publication.

The RSI on the daily chart has also dropped significantly during the last ten days. It dipped below neutral 50, indicating an initial shift in momentum in the negative direction. The OBV has likewise been steadily declining since mid-April.

Range settings remain in play.

AVAX has been trading in a range from $39.9 to $36.1 since mid-April. The mid-range level, indicated by the dotted white line at $35.9, is a crucial short-term level. The bulls were about to give it up to the bears as of press time.

Over the previous ten days, the RSI on the daily chart has also decreased significantly. As an early warning that momentum has been changing bearishly, it fell below neutral 50. Since mid-April, the OBV has also been on a sharp decline.

This drop demonstrated ongoing selling pressure. Over the last two weeks, the trend has calmed down, but it still indicates bearish dominance and a lack of purchasing pressure. Up until this element is altered, the decreasing pressure on AVAX will likely continue.

Subjective engagement is a factor in AVAX’s problems.

According to AmbCrypto – The Open Interest has been circling $200 million since May 23. In the meantime, the cost crept down from $38 to $36. Further losses were probably ahead, as futures traders did not appear inclined to bid the retest of the mid-range level.

It is noteworthy, although, that traders have not yet shorted the asset in large quantities, and the funding rate has stayed positive. In contrast, the spot CVD was in a strong downturn, much like the OBV. To put it plainly, given the selling pressure, a short-term recovery for AVAX seems doubtful.

Read more

Who is Pavel Durov? CEO of Telegram Under Arrest?

Jessica Hill is a dedicated journalist specializing in crypto news, with a profound interest in blockchain technology and digital currencies. With extensive experience in the financial sector, Jessica provides insightful analysis and in-depth coverage of the rapidly evolving cryptocurrency landscape. Her articles explore the intersection of technology, finance, and regulation, offering readers a nuanced perspective on developments within the crypto industry.