The White House repeatedly emphasizes Fed independence. It could be a ‘message’ for The Wall Street.

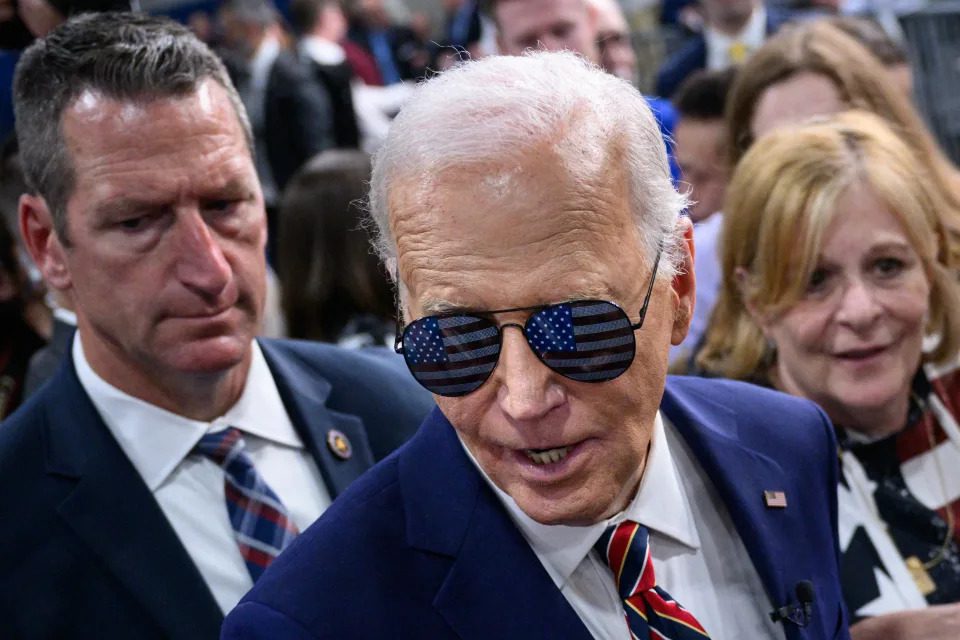

The Federal Reserve’s independence is going to be a topic of discussion for President Biden and his friends in 2024, the White House has made clear in recent weeks.

But it’s possible that these comments aren’t meant for those significant swing state voters.

The latest assault was initiated on Wednesday by the White House Council of Economic Advisors, who wrote a blog post emphasizing “the importance of an independent central bank.”

The writers of the piece stated that they “thought this was a good moment to explain,” going over a historical link between monetary policy intervention by the West Wing and unfavourable economic results.

And the reason is obvious: Donald Trump.

In recent months, the former president’s allies have put out a number of proposals that may undermine the independence of the Federal Reserve and possibly mislead the markets.

The suggestions include anything from removing Jerome Powell as chair of the Federal Reserve to a far-fetched scheme that was just revealed in the Wall Street Journal and involves the president himself determining interest rates.

Since polls frequently reveal that undecided voters are unaware of even the central bank’s function, it is possible that they are not following the back and forth.

However, Wall Street may still be a significant audience for the message.

Tobin Marcus, head of US policy and politics at Wolfe Research, says, “I read the White House’s emphasis on Fed independence as a message to market participants that a second Trump term won’t necessarily mean a repeat of the strong market performance from 2017-2019.”

While some voters may draw a comparison between interest rates and mortgage payments, AGF Investments senior US policy strategist Greg Valliere cautions that “if this becomes a big campaign issue it may simply reinforce concerns about instability in Washington.”

A barrage of remarks

In an interview with Yahoo Finance last week, Biden’s Council of Economic Advisers chair Jared Bernstein offered his thoughts on the subject.

In answer to a query concerning tariffs, he claimed that the essence of Trump’s plans was “deportation, devaluation, sweeping tariffs, and cutting the Federal Reserve off at the knees.”

He went on, “What we’re doing is very different.”

While President Biden frequently reiterates the value of central bank independence, in recent months he has also begun to predict interest rates and the actions of the Federal Reserve.

“I bet you that that little outfit that sets interest rates is going to come down,” Biden said in a March speech in Philadelphia.

It’s a prediction Biden — who largely avoided any sort of commentary on monetary policy in his first three years in office — has returned to at least twice in the months since.

White House press secretary Karine Jean-Pierre argues that Biden’s commentary is not an effort to direct the Fed. Instead, she says “he’s reflected a public interpretation of recent data. That’s what he’s speaking to.”

Biden stated, “I bet you that that little outfit that sets interest rates is going to come down,” during a speech in Philadelphia in March.

In the months following, Biden—who for the most part shied away from discussing monetary policy during his first three years in office—has at least twice revisited this prognosis.

Biden’s remarks, according to White House press secretary Karine Jean-Pierre, are not intended to influence the Fed. Rather, she claims, “He’s mirrored a public understanding of recent data.” He is addressing that specifically.”

Peter Navarro provided the most recent Fed analysis in the Trump world.

The former Trump aide is presently incarcerated for four months due to contempt of Congress. However, he informed Semafor via email that appeared to have been written from the prison library that, in his opinion, a Trump victory would mean Powell “will be gone in a hundred days one way or the other.”

Powell is not eligible to be removed from office until 2026, and the statute states that he can only be removed “for cause.” What would happen if a president attempted to fire the central banker due to a dispute over policy is unclear to legal experts.

Though he has never tried it, Trump has previously stated that he can fire Powell. At the moment, it seems that he is more concerned on his legal issues.

When the coronavirus epidemic first started in 2020, he made a public reference of it by assertively saying, “I have the right to remove” Powell during a news conference.

Additionally, he said, he could remove Powell from his chairship, “put him in a regular position, and put somebody else in charge.”

What exactly will Trump or Biden mean for Fed independence?

More recently, Trump has also discussed attempting to impose more authority over independent government organizations, such as the Federal Communications Commission and the Federal Trade Commission.

Similar to the Fed, those organizations function independently of the White House.

Additionally, according to his campaign website, Trump calls for “a top-to-bottom overhaul of the federal bureaucracies.”

Though it seems certain that the Fed will continue to be the subject of heated discourse until November, it is unclear how this will affect White House policy toward the Fed itself in 2025.

Marcus asserts that there is a “small but real chance of a fight over Fed independence early in a second Trump term.”

In the end, he believes that Trump will be discouraged “by the likelihood of a negative market reaction, but I have less confidence about that outlook than I’d like.”

More plainly, Valliere referred to the discussions around Trump as “hot air,” claiming that Wall Street would vehemently oppose any action.

But between now and then, he noted, there might be headline risk “as investors worry about Trump’s bombast.”

Read More:

Trump Taps Ohio Sen JD Vance as 2024 Running Mate: What You Need to Know

Washington’s Pivot on Bank Rules Can Free Up 10 Billion

Nvidia’s Q1 Profit up by 600%, 10:1 Stock Split Announced

Source

Yahoo finance

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.