The quick absorption of China’s yuan in President Vladimir Putin’s war economy, fueled by the fallout with the West over the invasion of Ukraine, may have reached the limit.

Countries that continue to conduct business with Russia face increased US pressure, particularly the potential of secondary penalties. That has proven to be an effective deterrent to increased yuan usage in the country, stifling bilateral trade and payments.

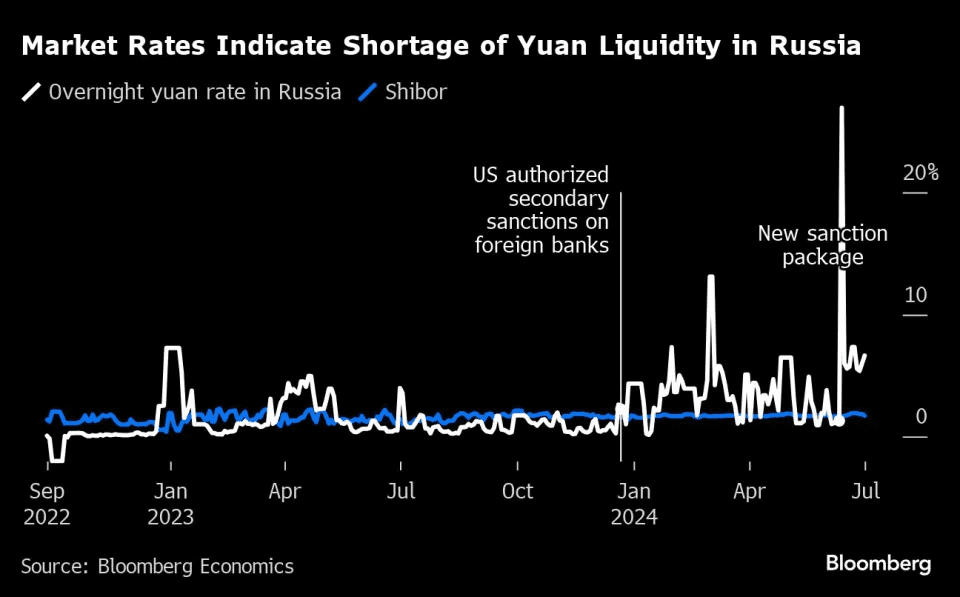

“Moscow may be more eager to adopt the yuan than Chinese banks are willing to accommodate,” Alex Isakov, Russia analyst at Bloomberg Economics, stated. “US secondary sanctions threats scare banks.” The market is showing a yuan shortage in Russia, as well as Chinese banks’ reluctance to supply liquidity, he adds.

The difference in yuan overnight borrowing rates between Russia and China expanded significantly after US Treasury Secretary Janet Yellen stated in December that the US will not hesitate “to take decisive, and surgical action against financial institutions that facilitate the supply of Russia’s war machine.” This disparity has remained several percentage points since the warning.

In December, the US imposed secondary penalties against foreign financial institutions, while China’s state-owned banks increased restrictions on funding for Russian clients.

In a report published late Tuesday on financial market risks, the Bank of Russia reported that it had to increase its offer of yuan liquidity under swap operations as a rise in demand following the termination of dollar and euro swaps prompted rates to spike to 31%. That helped decrease rates to 5%-7% versus 0%-5% before the sanctions were imposed, according to the report.

China’s Yuan Trade Report

According to China customs data, in just two years, Russia has surpassed Germany, Australia, and Vietnam in terms of trade volume with China. In 2023, trade volume increased by almost 60% to $240 billion. Russia gains access to a large variety of consumer and high-tech goods while China gains by paying less for Russian oil and other commodities.

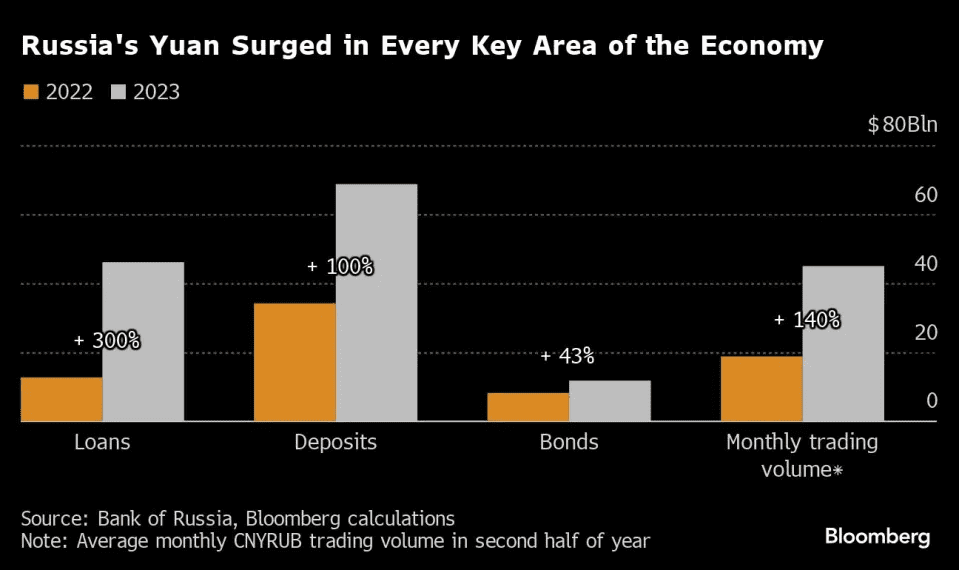

China has consequently emerged as Russia’s principal trading partner and the yuan currently represents more than half of trading activity on the country’s foreign exchange market in addition to approximately 40% of export and import payments from Russia. Given that Russia’s yuanization began at nearly zero in the beginning of 2022—before Putin invaded Ukraine—the extent of its yuanization is even more striking.

Because of this, Beijing’s efforts to strengthen the yuan’s position in international payments have received the greatest support from Russia.

According to estimates from Bloomberg Economics, 29% of the growth in China’s yuan-settled trade share during the first quarter of this year has come from Russia. This trend has been continuing since 2021. Nearly all of Russia’s trade with China is conducted in yuan, and since its exports to China are greater than its sales to China estimates suggest that other nations are paying Russia in yuan.

Nevertheless, based on China’s customs data, Bloomberg calculated that the annual growth in total trade between China and Russia dropped to barely 3% in the first five months of 2024 from around 42.5% a year earlier. The proportion of commerce with Russia carried out in friendly currencies remained unchanged.

As per the Bloomberg Report

The adoption of the yuan in Russia might have peaked in 2023 for two reasons. First, several of China’s biggest institutions are strongly discouraged from doing business with their Russian counterparts by the prospect of secondary penalties. Strong evidence is provided by the abrupt and ongoing decoupling of Russian overnight yuan rates from Shibor following Janet Yellen’s remarks. Second, the main source of Russia’s yuan usage is its oil exports, while other nations are still hesitant to accept yuan as payment for imports. This implies that Russia’s yuan trade would also stay static in the upcoming quarters if oil prices did not increase.

A number of the largest banks in China ceased to take yuan from Russia, which caused a temporary disruption to imports. After Putin met with Chinese President Xi Jinping in May, Russian businesses told local media that the problem was fixed by utilizing small regional banks, but the nation’s officials have stated that worries still exist.

The amount of trade that Russia does with China determines the peak at which the yuan will be used, according to Alexander Gabuev head of the Carnegie Russia Eurasia Center. “A lot will also depend on how commonly the yuan is used as a medium of exchange for international payments.”

Evidence of the yuan’s rising prominence in Russia’s economy can be found everywhere. When the Netherlands’ Yandex NV sold its Russian business, US stockholders received yuan rather than dollars or euros, which were impossible to transfer from Russia, according to two persons familiar with the roughly $2.5 billion cash component of the transaction who asked not to be identified.

Companies have used the yuan alongside the ruble to convert dollar and euro loans and issue new bonds, and the Bank of Russia uses the Chinese currency for National Wellbeing Fund operations.

At the start of this year, the yuan surpassed the dollar in terms of deposits in Russian banks, making it the primary foreign currency for savings. In 2023, the number of yuan deposits in Russia doubled to $68.7 billion, making it many times larger than in other top offshore yuan economies such as the United Kingdom and Singapore.

The last wave of US restrictions in June halted exchange transactions for the dollar and euro in Russia. According to the Bank of Russia report, the yuan has become the only liquid currency accessible for trades and purchases in brokerage accounts in the country, accounting for 99.6% of total volume.

“There is still potential to increase yuan usage, but it is small and insignificant compared to the move that has already occurred,” said Sofya Donets, an economist with T-Investments. “Most of the journey has already been completed.

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.