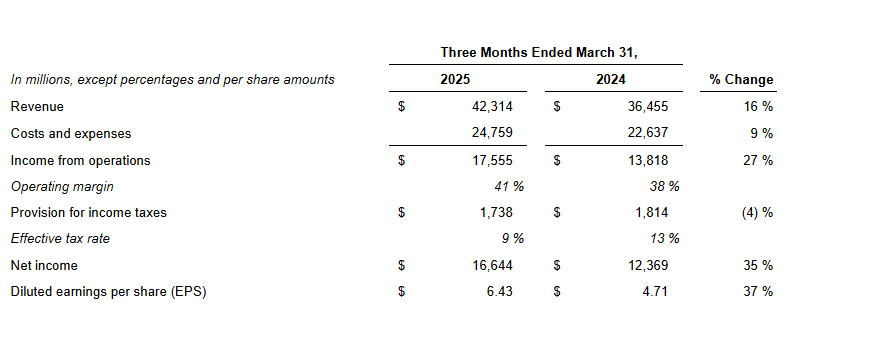

The financial results of Meta Platforms, Inc. (Nasdaq: META) for the quarter that concluded on March 31, 2025, were released today.

Table of Contents

Meta’s profits for Q1 2025 surpassed Wall Street’s expectations for both sales and profit, despite concerns about a potential decline in advertising due to international tariffs and uncertainty surrounding China. In addition to raising its full-year capital expenditure forecast, the company provided a positive outlook for Q2.

Meta First Quarter 2025 Financial Highlights

Good Prospects for Q2 Despite Ad Market Wariness

Despite concerns about a potential slowdown in global advertising due to rising tariffs, Meta surprised the market by predicting its Q2 revenue would be between $42.5 billion and $45.5 billion, surpassing Wall Street’s consensus estimate of $44 billion.

Additionally, Meta raised its capital expenditure guidance to $114 billion to $119 billion, an increase from the previous estimate of $113 billion to $118 billion. This adjustment reflects the company’s commitment to long-term investments, particularly in AI and metaverse infrastructure.

- Capital Return Program: We repurchased $13.40 billion worth of our Class A common stock and made total dividend and dividend equivalent payments of $1.33 billion.

- Cash, Cash Equivalents, and Marketable Securities: As of March 31, 2025, our cash, cash equivalents, and marketable securities amounted to $70.23 billion. We generated $24.03 billion in cash flow from operating activities, resulting in a free cash flow of $10.33 billion.

- Headcount – Headcount was 76,834 as of March 31, 2025, an increase of 11% year-over-year.

Ad Strength vs China Exposure

Meta is more vulnerable to fluctuations in digital advertising expenditures, particularly those influenced by geopolitical factors, as it lacks a corporate cloud division like its competitors, Microsoft and Amazon.

Analysis of the CFO Outlook

We have updated our previous projection for full-year 2025 capital expenditures from $60-65 billion to a new range of $64-72 billion.

This figure includes principal payments on finance leases. The revised outlook reflects an anticipated increase in the cost of infrastructure hardware and additional investments in data centers to support our artificial intelligence initiatives.

In 2025, the majority of our capital expenditures will continue to focus on our core business.

We expect our full-year 2025 tax rate to range from 12 to 15 percent, unless there are changes to our tax environment.

We are actively monitoring the regulatory landscape, particularly the legal and regulatory challenges in the EU and the U.S. that could significantly affect our business and financial results.

Recently, the European Commission (EC) announced that our subscription model, which offers an ad-free experience, does not comply with the Digital Markets Act (DMA).

Following feedback from the EC regarding the DMA, we anticipate that we will need to make some changes to our model.

These modifications could lead to a noticeably worse user experience for European users and could significantly impact our business and revenue in Europe as early as the third quarter of 2025.

We plan to appeal the EC’s decision on the DMA, but any necessary changes to our model may need to be implemented during the appeal process or before its conclusion.

Details of Webcasts and Conference Calls

Meta will host a conference call today at 2:00 p.m. PT/5:00 p.m. ET.

The call’s live webcast, the company’s earnings press release, financial tables, and slide show are all available on the Meta Investor Relations website at investor.atmeta.com.

A replay will be accessible on the same website after the call.

The investor.atmeta.com website will also feature the transcripts of the conference calls with publishing equity research experts that were conducted today.

With a strong forecast for Q2 and a clear expansion roadmap, Meta now faces a dual challenge: excelling in the boardroom while defending its business model in court.

Read more

Trump Blames Zelensky as Ukraine Peace Efforts Falter

China Voices Concerns Over US Tariffs and Sanctions

Andrew is a New York-based markets reporter at The Wall Street , covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. He is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. He holds BTC and ETH.