The 2024 Indian elections have sparked global interest, not just for its political ramifications in India but also for their possible impact on international US markets, particularly in the United States.

As the world’s largest democracy, India’s political landscape has the potential to profoundly impact global economic dynamics, including financial markets like the NASDAQ and NYSE.

The Indian Election 2024: A Brief Overview

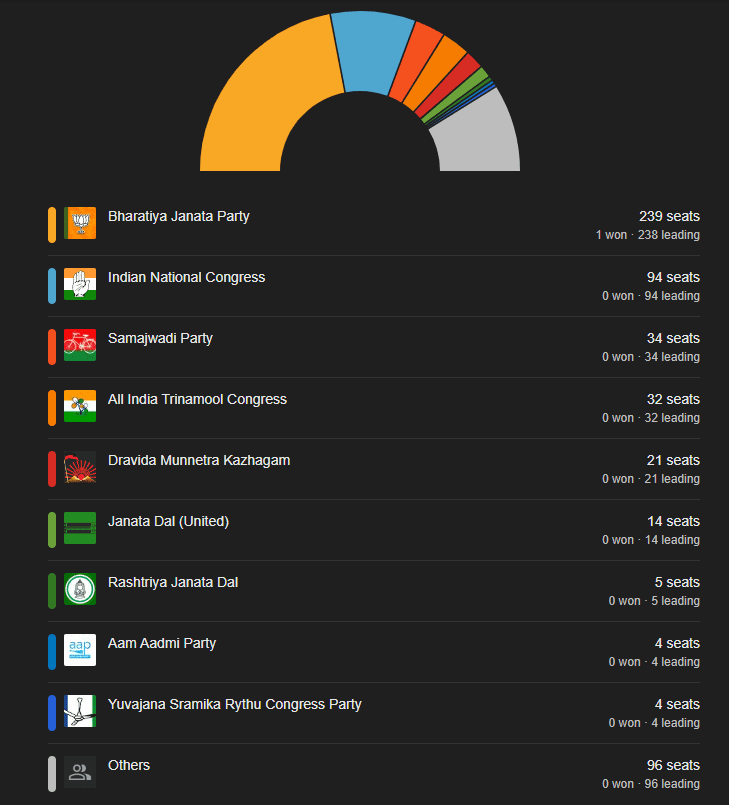

Lok Sabha Election – Live Results

Indian Election 2024: Who Will Win?

The 2024 Indian general elections is the hard competition between the major political parties mainly the Bharatiya Janata Party (BJP) and the Indian National Congress (INC) as well as major regional parties

The elections were marked by disputes about economic changes social programs and India’s position in global geopolitics The results of these elections will influence Indian economic policy trade partnerships and foreign investments for the next five years

Problems

- Market Uncertainty: Financial market volatility can be brought on by-elections Changes in policies that could affect economic growth and stability worry investors

- International businesses: may be impacted by changes in trade regulations US firms operating in India may be impacted by the Indian government’s stance on trade tariffs import-export regulations and foreign direct investment (FDI) policies.

- Sectors with significant: investments from US firms, such as technology pharmaceuticals and manufacturing, may be impacted by changes in regulatory frameworks.

- Currency volatility: The results of the election could affect the Indian Rupee’s volatility which would have an effect on exchange rates and directly affect US businesses that have business dealings with India.

Case Study: Impact on the Technology Sector

The Indian elections may have an impact on the US market, particularly in the IT sector. Companies such as Apple, Microsoft, and Google conduct large-scale software development and customer support operations in India.

- Problem: If the incoming government implements stricter data localization requirements that require enterprises to maintain data locally, US IT firms may face higher operating costs.

- Solution: In order to comply with new requirements companies may need to make investments in local data centers or work with Indian firms. This might result in more collaborations and collaborative ventures, which would promote growth and innovation.

- Effect on US Market: Investors’ concerns about the upfront fees could cause stock prices to temporarily decline. Long-term advantages however could include a more secure position in the Indian market which could increase stock prices and investor trust.

Taxation Implications

- Multinational corporations give considerable consideration to tax policies. The new tax policy of the Indian government on corporations International tax treaties and the Goods and Services Tax (GST) may have far-reaching effects.

- Corporation Tax Rates: Reducing corporation tax rates may encourage more overseas investment, even from US businesses. In contrast increased taxes might discourage investment.

- GST Reforms: Businesses can gain from streamlining GST procedures by saving money on compliance and boosting productivity US businesses in the retail and consumer products sectors may benefit the most from this.

- Double Taxation Avoidance Agreements (DTAA): By fortifying the DTAA between the US and India more US companies may choose to grow in India by preventing double taxation problems.

Solutions and Strategy

- Diversification: Investors can reduce risk by diversifying their assets Investing in industries that are less susceptible to political change such as utilities or consumer staples can give stability.

- Hedging: involves using financial products such as futures and options to safeguard against currency and market volatility. This is especially important for businesses with extensive exposure to the Indian market.

- Local Partnerships: Creating strategic alliances with local firms can assist US companies in navigating regulatory changes and leveraging local experience.

Impact on US Stock Markets

- NASDAQ: Technology-heavy. Concerns about regulatory changes and increasing operational costs for technology companies may cause short-term volatility on the NASDAQ. However, long-term growth prospects remain favourable if businesses adjust properly.

- NYSE: Companies listed on the NYSE with significant operations in India, such as consumer products and medicines, may see swings due to trade rules and tax reforms. A good business environment in India may improve their stock performance.

What are the potential risks for US investors?

- Market Risk: This risk stems from day-to-day price fluctuations in stocks, bonds, and commodities. While it can be concerning for short-term investors those with a longer horizon may accept it for potential long-term returns.

- Interest Rate Risk: Linked to market risk changes in interest rates impact bond values. Rising rates decrease bond prices, affecting yield. Consider your investment horizon when assessing this risk.

- Credit Risk: The risk that a borrower (e.g., a company or government) may default on debt payments. Diversification and credit quality assessment help manage this risk.

- Inflation Risk: Even “safe” investments can lose value due to inflation eroding purchasing power over time. Consider assets that outpace inflation.

- Liquidity Risk: Some investments may be difficult to sell rapidly without causing major price changes Balance liquidity demands with investment options.

- Currency Risk: If you invest worldwide, currency rate swings might impact results. Hedging tactics can help to lessen this risk.

- Political risk: Changes in government policies and legislation, or geopolitical events might affect investments Keep up with current events across the world.

- Systematic versus Unsystematic Risk: Systematic risks impact the entire market (e.g., economic downturns) whereas unsystematic risks are exclusive to individual enterprises or industries.

Conclusion

Beyond merely being a local political event the general elections in India in 2024 will have a significant impact on the global economy and the US economy Businesses and investors need to be informed about potential changes to India’s regulatory framework and economic policies. Through the identification of roadblocks and implementation of calculated solutions they may manage uncertainty and take advantage of development opportunities.

In the current integrated global economy, political shifts in one of the largest economies on earth are probably going to have a significant impact on investment markets and commerce.

Who is most likely to win the election in 2024 in India?

If history were to repeat itself and NDA gets more seats than a consensus 350-plus, it could bring more upside for the stock market. Elections results 2024: Given the unanimity across all the exit polls, the formation of a stable NDA government is the most likely outcome, said one brokerage.

Is the BJP likely to win?

All major exit polls have predicted a smooth win for the BJP-led National Democratic Alliance (NDA). While India-Today-My Axis poll and Today’s Chanakya projected the NDA to cross 400 seats, ABP-CVoter estimated 353-383 seats. Jan Ki Baat gave a seat count between 362-392 seats

When come election results in 2024?

The Lok Sabha election has been concluded successfully on 1st June 2024. Now, all people of India are eagerly awaiting the most decisive results which will come out on 4th June 2024.

How many seats for NDA 2024?

A total of 400 vacancies were announced for the NDA 1 2024 exam.

Who Will Win, the BJP or Congress?

Lok Sabha Election Results 2024 LIVE Updates: BJP leading on 17 seats, INC on 8 Lok Sabha seats in Karnataka. BJP is currently leading on 17 seats, more than the half-way mark of 14 seats in Karnataka

Mike Neon is a seasoned journalist specializing in United States news, known for his comprehensive coverage of national affairs and current events. With a career spanning 5 years in journalism, Mike has established himself as a reliable source of accurate and insightful reporting. His articles delve deep into political developments, social issues, and cultural trends shaping the United States today. Mike Neon’s dedication to providing balanced perspectives and in-depth analysis ensures that readers stay informed about the latest developments that impact the nation.