Pre-Election – Australian Treasury stated. “The larger deficit is driven by the government’s cost-of-living relief and addressing unavoidable spending pressure.

(Bloomberg) — Australia intends to unleash a tsunami of expenditure, ranging from electricity bill subsidies to tax incentives for crucial minerals and new warships, as the centre-left government attempts to reclaim voters ahead of an election in a year.

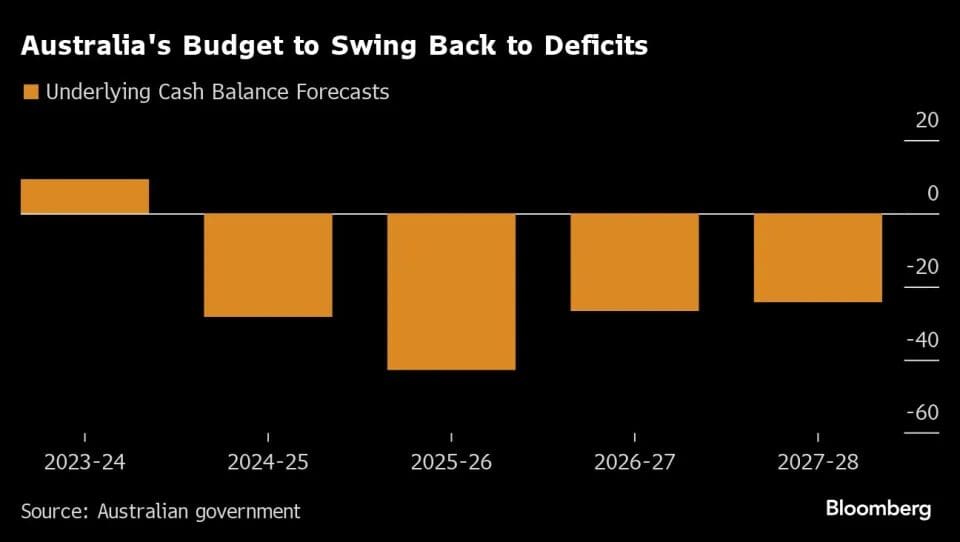

The government’s books will return to a deficit of A$28.3 billion, or 1% of GDP, in fiscal 2025, rising to A$42.8 billion in the following 12 months, according to budget papers presented on Tuesday.

The 2025 deficit is more than twice economists’ expectations, coming after the government produced surpluses in its first two years in power as it worked to control inflation.

“Australia faces long-term fiscal challenges due to climate change, an ageing population, regional security and rising demand for care and support services,” the Australian Treasury stated.

“The larger deficit is driven by the government’s cost-of-living relief and addressing unavoidable spending pressure.”

Treasurer Jim Chalmers is attempting to steer a credible fiscal course by moving important programs, such as the government’s trademark Future Made in Australia program, which intends to capitalize on the green revolution, and assistance for essential minerals, out to the end of the decade.

The budget disclosed that the near-term deficits are driven by cost-of-living relief and A$15.4 billion for health and frontline services that were left empty by the previous government.

Economists noted that the government’s books going back into the red suggests a more expansionary fiscal impulse that may cause interest rates to remain higher for an extended time.

According to Su-Lin Ong, chief economist for Australia at the Royal Bank of Canada, “the treasurer is not making the Reserve Bank’s job any easier with this budget.”

It will become more difficult to bring inflation, especially core inflation, back to target consistently. Rates will probably be suspended as a result for a while.

Government support for living expenses consists of A$3.5 billion to assist in lowering energy costs, with the extra benefit of reducing projected inflation by roughly 0.5 percentage points in the year ending in June 2025. According to Treasury forecasts, inflation may reach the RBA’s 2-3% target later this year, roughly a full year ahead of the central bank’s own projections.

According to RBC’s Ong, the energy relief will lower the CPI temporarily but also free up household income for spending, which could lead to inflation.

Most Read from Bloomberg

Australian Government’s Pre-Election 2024-25 Budget: Key Forecasts

As of now, rate traders are much in line with the RBA’s view, which assumes that there will be no changes this year and that policy easing will start around March 2025. November is when economists predict the first rate cut will occur.

In order to raise the cash rate to 4.35%, the RBA raised it thirteen times between May 2022 and November 2023. Should inflation continue to be stubborn, additional tightening may be considered.

Australia is still in better health than the US and other major economies notwithstanding the deficits that lie ahead and the surplus in the current fiscal year. Because of this, Australia’s economy is one of the few to get a AAA credit rating from all three rating agencies.

The other major spending items for the Australian government include A$22.7 billion for the Future Made in Australia initiative, which intends to increase investment in high-tech manufacturing and green mining, and A$330 billion for the military over the next ten years.

This includes A$7 billion over 11 years for essential minerals, together with a 10% production tax incentive to promote downstream refining and processing, and A$6.7 billion in incentives over a decade to assist build a renewable hydrogen industry.

Still, the vast majority of this spending has been deferred to future years. Tax breaks for essential minerals and hydrogen are only due to begin in fiscal 2028, despite Australia’s nickel producers facing competition from low-cost foreign sources, notably Indonesia.

The government’s coffers have been bolstered by revenue from high commodity prices and a fully employed economy (unemployment at 3.8%). The budget reveals that both of those strengths are weakening, with the unemployment rate predicted to rise to 4.5% by June 2025 and the terms of trade – the ratio of export prices to import prices – expected to fall 7.75% next fiscal year.

Another element that enhanced budget revenue was stronger-than-anticipated migration, which is now predicted to fall to 260,000 next fiscal year from 528,000 in the 12 months through 2023. The government also intends to change other visa categories, including a new one designed to attract extraordinarily skilled migrants that will replace two existing classes.

Because of the expanding budget deficits, borrowing projections have grown; in June 2026, net debt is expected to be A$615.5 billion, or 21.5% of GDP, compared to experts’ projections of 19.9%. Australia also does quite well internationally, with a developed world average of above 80%.

Chalmers cautioned that the world economy’s troubles with tight monetary policy, China’s slowdown, and the disruptions brought on by wars in the Middle East and Eastern Europe would make the financial situation challenging in the years to come.

According to the Treasury, the world economy will grow at 3.25% per year across the following three years, ending in 2026.

It explained that since the early 1990s, “this would represent the longest stretch of below-average global growth.” “Global policy focus will begin to shift to solving risks to growth as inflationary concerns abate and labour markets become softer.”

Read more

Israeli-Friendly Fire Killed 5 Soldiers in Gaza

IEA’s 2024 Oil-Demand Growth Forecast: What You Need to Know

Andrew is a New York-based markets reporter at The Wall Street , covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. He is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. He holds BTC and ETH.