Hot Inflation Data Moves Dow Jones Futures Higher; Powell to Follow; GameStop Rockets 120%

Tuesday saw mixed futures for the Dow Jones Industrial Average and other key indices as Wall Street responded to scorching Labor Department inflation data ahead of remarks from Federal Reserve Chairman Jerome Powell. In the meantime, GameStop (GME) temporarily surged over 130% on the stock market today in an attempt to build on its major gains from Monday.

Dow Jones futures rose 0.1% compared to fair value in premarket trading, while S&P 500 futures rose somewhat. Nasdaq 100 futures, which focus on technology, fell 0.1% before the opening bell.

Early Tuesday, the 10-year Treasury rate fell to 4.47%. Further, oil prices fell when West Texas Intermediate futures traded. around $78.50 a barrel.

The Nasdaq 100 tracker Invesco QQQ Trust ETF (QQQ) lost 0.4%, as did the SPDR S&P 500 ETF (SPY).

GameStop shares more than doubled Tuesday morning, on track to add to Monday’s massive gains. The volatile stock just increased by over 120%. Meanwhile, AMC Entertainment (AMC) surged more than 110% in premarket trade.

For the first time in three years, Keith Gill—the guy behind the pandemic’s spike in meme stocks—returned to social media on Monday. Gill, commonly referred to as Roaring Kitty, posted something on social networking site X on Sunday night for the first time in June 2021. The post’s widely shared photo implied that he is “getting serious.”

Current Stock Market: PPI Inflation Analysis

The Biden administration announced new tariffs on Chinese goods worth $18 billion early on Tuesday, saying the need to protect America’s companies from unfair competition.

In addition, the Labor Department said that April showed a 0.5% increase in the producer price index, a key indicator of wholesale inflation with an annual increase of 2.2%. According to Econoday predictions, the PPI was predicted to increase by 0.3% for the month of April and by 2.2% annually.

In addition, the core PPI increased by 0.5% for the month and by 2.4% over the previous year. It was predicted to increase by 2.3% year over year and by 0.2% on the month.

Dow Jones Breaks a Winning Run

The eight-day winning streak ended on Monday when the Dow Jones Industrial Average fell 0.2% and the S&P 500 dropped less than 0.1%. The technology-heavy Nasdaq composite increased by 0.3%.

“The Cboe Volatility Index, commonly known as the VIX, fell to 12.55 Friday, reflecting a rapid cooling of investor fear since the index rose to 21.36 on April 19. The so-called fear gauge bounced Monday to 13.59. A calm market is not necessarily a bad sign. It reflects investor confidence.

As the old Wall Street refrain goes, never short a dull market. Moreover, a pause seems quite appropriate if the stock market is gearing up to make an assault on its March highs.”

The IBD Live crew talked about the current trading circumstances on Monday’s broadcast. IBD employee Arnie Gutierrez talked about his “giddy level” and why he prefers to sell a stock when it hits an all-time high. Gutierrez also covers Kanzhun (BZ), a commercial employment company and Chinese mobile app developer. Coworker Justin Nielsen of IBD reviewed the weekly industry group study and emphasized the Nasdaq’s current underperformance in comparison to the S&P 500 this year.

With all of the recent volatility in the stock market, now is a good time to read The Big Picture column. Additionally, be sure to read about how to use IBD’s new exposure limits to adapt to shifting market situations. peaks.”

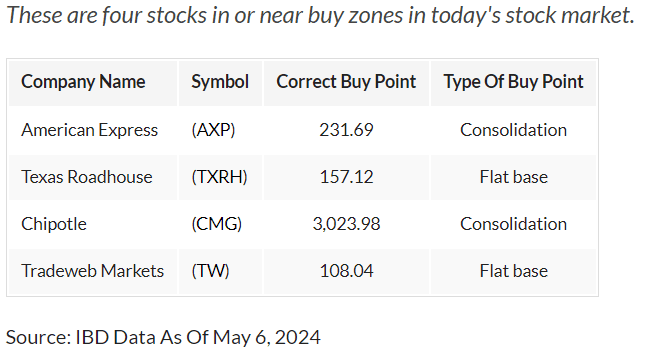

Stock Market Today: Best Stocks To Watch

JPMorgan Chase (JPM) and Merck (MRK), two Dow Jones components, NetApp (NTAP), NXP Semiconductors (NXPI), Taiwan Semiconductor Manufacturing (TSM), and Tradeweb Markets (TW) include a few of the best stocks to keep an eye on right now.

JPMorgan and Taiwan Semi are featured in this column headlined “Stocks Near A Buy Zone.”

An excellent resource to find daily breakouts is IBD MarketSurge’s “Breaking Out Today” list. Here are the MarketSurge Rising 250 stocks that are outperforming new purchase points. Additionally, on a flat basis, KKR (KKR) broke over the 103.48 purchase point. Conversely, the MarketSurge “Near Pivot” list shows stocks that are approaching buy points.

Dow Jones: JPMorgan, Merck

JPMorgan is quickly approaching the 200.94 entry point of a flat base after making significant advances in previous weeks. Today, shares on the stock market increased somewhat.

Merck, the pharmaceutical behemoth, is currently developing a flat base with a 133.10 entry. Tuesday’s stock price of Merck fell 0.2%.

MarketSurge reports that NetApp is trading slightly below a 108.82 buy mark in a double bottom outside of the Dow Jones index. Tuesday’s opening saw a 0.7% increase in NetApp shares.

At 251.96, NXP Semiconductors is in the buy range after a double-bottom entry. Tuesday’s stock increase was 0.1%.

Following Friday’s impressive monthly sales numbers, chipmaker Taiwan Semiconductor is attempting to break out past a 148.43 purchase target in a double-bottom base. On Tuesday, the stock gained 0.1%.

With a 0.7% decline on Monday, Tradeweb is firmly within its purchase range beyond a flat base’s 108.04 buy point. Tuesday’s stock loss was 0.4%.

Stock Market Today: Companies To Watch

Magnificent Seven Stocks: Nvidia, Tesla

Nvidia (NVDA) dropped 0.9% among the Magnificent Seven stocks on Tuesday morning, while Tesla (TSLA) increased 2.2%.

On Monday, Nvidia’s stock continued to rise above its 50-day moving average. The buy price of the massive artificial intelligence company’s stock dropped from 974 to 922.20 on Monday as it added a handle to its base. A Leaderboard stock is the leader in AI.

On Monday, Tesla stock ended a four-day losing run. The stock is exactly at its 50-day line after the losses of the previous week.

Dow Jones Leaders: Apple, Microsoft

Following Tuesday’s opening bell, Apple (AAPL) and Microsoft (MSFT), two of the Dow Jones stocks that make up the Magnificent Seven, had mixed trading.

On Monday, Apple’s stock increased 1.8% and closed at its highest point since February 12. The market is creating the right half of a new base with the shares once again above their 200-day moving average. Tuesday am saw a 0.9% increase in the stock.

On Monday, Microsoft’s stock fell 0.3%, exactly at the 50-day line. The 50-day line will be a significant obstacle for the software behemoth, which is developing a flat foundation with a 430.82 buy target. Additionally, Microsoft’s shares fell 0.4% on Tuesday.

Read More

US-China EV Trade 2024: The Battle for Clean Transportation

Australia’s Pre-Election Spending Returns to the Red Budget

Zach Cooper is an experienced Crypto & Financial news journalist, having written for Moneycheck.com, The wall street, Computing.net and is Editor in Chief at wallstreetsights.com