The most recent inflation data suggests that the stock market boom may have ‘much greater upside’.

After a rocky start to 2024, the latest inflation figures may provide additional fire for the ongoing stock market rebound.

Inflation falling continues to be one of the primary factors behind the bull market in stocks,” wrote Julian Emanuel, Evercore ISI’s equity, derivatives, and quantitative strategy leader, in a note to investors.

Stock market overview on Monday

On Sunday Emanuel increased his year-end price prediction for the S&P 500 (^GSPC) to 6,000 from 4,750. Emanuel cited the positive inflation trend and the “early innings” of the AI trade for raising his year-end target to the highest on Wall Street.

Last week, the S&P 500 and Nasdaq (^IXIC) closed with four consecutive record highs, despite lower-than-expected inflation readings for consumer and wholesale prices.

UBS Investment Bank’s chief US equity strategist Jonathan Golub, who has one of the highest S&P 500 year-end targets on the street at 5,600, believes this week’s inflation data, and what it could mean for future interest rate cuts, “provide the potential for even greater upside” to his year-end forecast.

Golub’s optimism is rising as inflation makes its most substantial advance toward the Fed’s 2% target since the beginning of the year. This is boosting expectations for rate reduction – and bringing Treasury rates, a prominent drag for stocks over the last year lower.

The May Consumer Price Index (CPI) revealed that “core” CPI which excludes volatile food and energy categories rose by 0.2% month on month the lowest figure since June 2023. Meanwhile the “core” Producer Price Index (PPI) which excludes volatile food and energy categories, remained constant in May from the previous mont falling short of economists forecasts for a 0.3% increase

Bank Of America Stephen Juneau a US economist noted that Thursday’s PPI supports their opinion that disinflation is the most likely path forward and cited a “A+ report” for May core PCE. According to BofA, core PCE grew 0.16% month over month in May.

The May CPI and PPI data are favorable for our view that the Fed will be reducing its policy rate later this year Juneau stated. “We see recent inflation data as significantly decreasing the Fed’s need to raise rates, and labor market data as indicating that the chance of rapid rate reduction is similarly low.

An easing cycle that begins in September remains a possibility particularly if shelter inflation were to moderate further in the next couple of months.

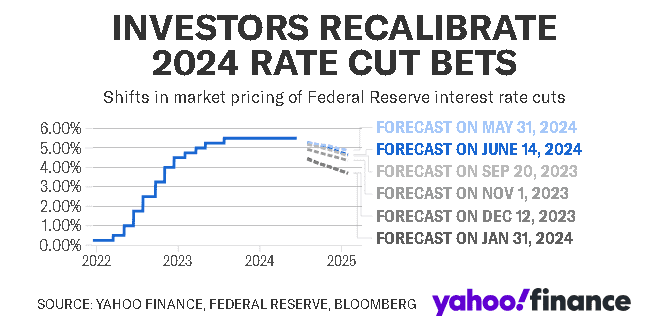

The inflation data appears to have encouraged investors in the face of the Fed’s most recent Summary of Economic Projections (SEP), which revealed that the median expectation for rate cuts reduced to just one in 2024. Markets are now more confidently pricing in two interest rate decreases this year than they were before the week.

Some attribute this to the data’s publication date. The CPI report came just hours before the Fed released its, and while Fed Chair Jerome Powell acknowledged that officials are allowed to revise their projection after an economic data release, “most people don’t.”

And the Fed’s call was tight, with only one more official in support of a single cut as opposed to two. Wall Street experts think the Fed’s forecast may already be outdated given the slim majority and the fact that the second positive inflation report of the week was released just after the Fed had concluded its meeting.

Chief global strategist David Kelly of JPMorgan Asset Management said, “Honestly, if [the inflation data] happened a week earlier, I think that might just have been enough to keep another two people on the two-rate-cut bandwagon,” during a media roundtable on Thursday.

Kelly said the latest data strengthened the argument that inflation is gradually declining in the direction of the Fed’s 2% target. “The soft landing continues,” Kelly added, unless the US economy experiences an unanticipated shock that causes it to change direction.

Zach Cooper is an experienced Crypto & Financial news journalist, having written for Moneycheck.com, The wall street, Computing.net and is Editor in Chief at wallstreetsights.com