On Wednesday, investors will review one of the most critical data points that may influence future Federal Reserve interest rate policy: the July Inflation Price Index (CPI).

The report is scheduled for release at 8:30 a.m. ET on Wednesday is expected to show headline inflation at 3.0%, unchanged from June’s estimate.

Consumer prices are predicted to rise 0.2% over the previous month up from a 0.1% fall the previous month, as energy prices are expected to rise again.

On a “core” basis, which excludes the more variable expenses of food and gas, prices are predicted to grow 3.2% over last year in July, slowing from the 3.3% annual gain reported in June. According to Bloomberg data, monthly core prices are likely to rise 0.2%, up from a 0.1% gain in June.

“CPI in June surprised to the downside,” Bank of America analyst Michael Gapen said in a note ahead of the data. “We expect some of that surprise to reverse in July.”

July Inflation Price Index Data

June’s Inflation report marked the first time since May 2020 that the monthly headline CPI was negative. It was also the slowest annual increase in prices since March 2021.

While July’s inflation report will most likely not be “quite as low as June, it is in line with prior trends in deflation and should meet the Fed’s benchmark for beginning rate cuts in September,” Gapen stated.

key inflation has remained stubbornly high due to rising costs for housing and key services like as insurance and medical care.

Shelter prices are projected to reverse June’s decline, as the rent index and owners’ equivalent rent (OER) reported the weakest monthly gains since August 2021. Owners’ equivalent rent is the hypothetical amount a homeowner would pay for an identical property.

Non-housing services also declined in June, “owing in large part to a plunge in airfares,” according to Bank of America’s Gapen. However, the decline in airfares is expected to be considerably more moderate in July.

“Non-housing services inflation should moderate over time given cooling services wage inflation; however, a sustained period of deflation is unlikely,” according to his estimate.

To cut or not to cut?

Ahead of Wednesday, the Producer Price Index (PPI) came in lower than expected in July, raising investor expectations and reinforcing the case for Fed rate cuts.

US producer prices, a crucial metric of wholesale inflation and frequently a predictor of where consumer prices are headed, climbed only 0.1% month on month last month, after climbing 0.2% in June. The speed fell short of economists’ expectations. The index increased 2.2% year on year slightly above the Federal Reserve’s 2% inflation objective.

“It’s positive for equities” Oppenheimer’s chief investment strategist, John Stoltzfus, told Yahoo Finance’s Morning Brief on Tuesday morning. “It dispels some of the negative vibe that had dominated [the market] since the beginning of the month. We can’t help but think that this gives the Federal Reserve the opportunity to begin cutting rates.”

Inflation has stayed over the Federal Reserve’s 2% objective on an annual basis. However, recent economic data, especially a sell-off-inducing July jobs report, has fueled the perception that the central bank should decrease interest rates sooner rather than later.

Notably, the Fed’s preferred inflation indicator, the so-called core PCE price index revealed that inflation in June remained constant from the previous month with the smallest annual growth in more than three years.

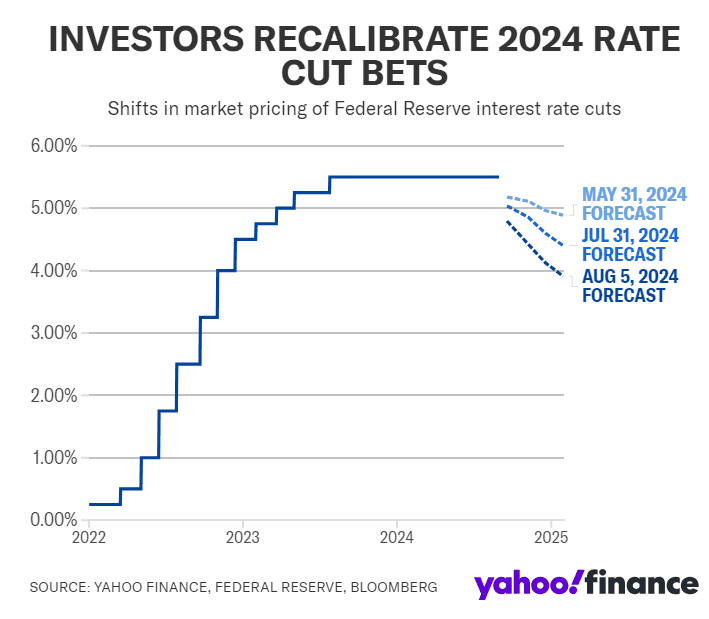

As of Tuesday, markets were pricing in a nearly 100% likelihood that the Federal Reserve will drop interest rates by the conclusion of its September meeting. However, the odds of a 50 basis point or a 25 basis point decrease are now split 50/50 following a roughly 60/40 likelihood set by traders. last week, per the CME FedWatch Tool.

Read more

Why Investors Are Turning to Volatility Funds in an Unstable Market Environment

Asian Stock Markets Rally: Earnings Season Boosts Stocks and Currencies

Jessica Hill is a dedicated journalist specializing in crypto news, with a profound interest in blockchain technology and digital currencies. With extensive experience in the financial sector, Jessica provides insightful analysis and in-depth coverage of the rapidly evolving cryptocurrency landscape. Her articles explore the intersection of technology, finance, and regulation, offering readers a nuanced perspective on developments within the crypto industry.