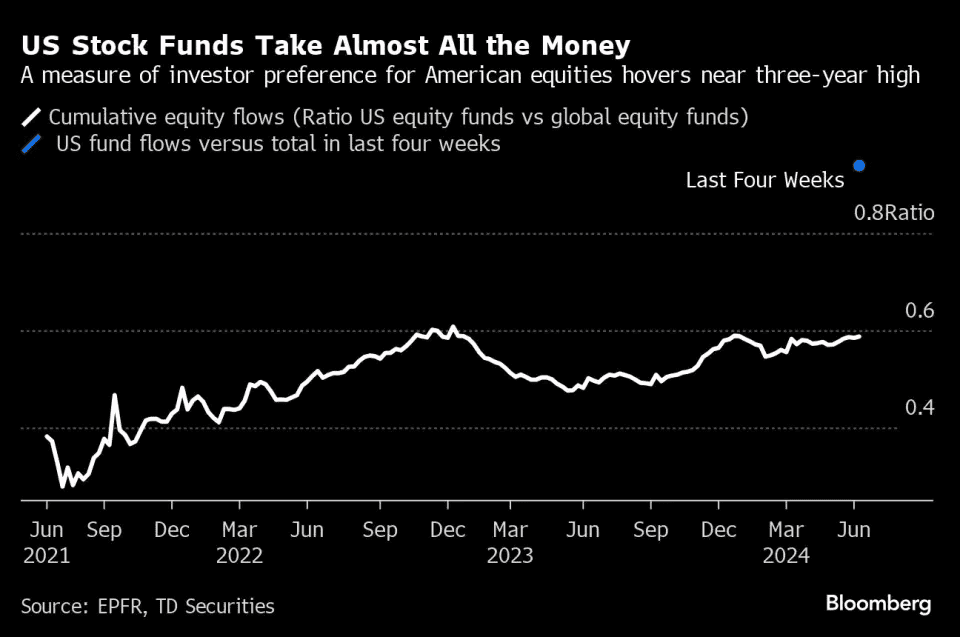

Due to domestic political unrest and stagnant economies, foreign investors are increasingly pushing into the congested trade that is American markets.

According to TD Securities’ compilation of EPFR Global data, over $30 billion in new capital has poured into stock funds in the past month with 94% of the allocations going toward US assets, particularly tech companies.

Impacts On American markets

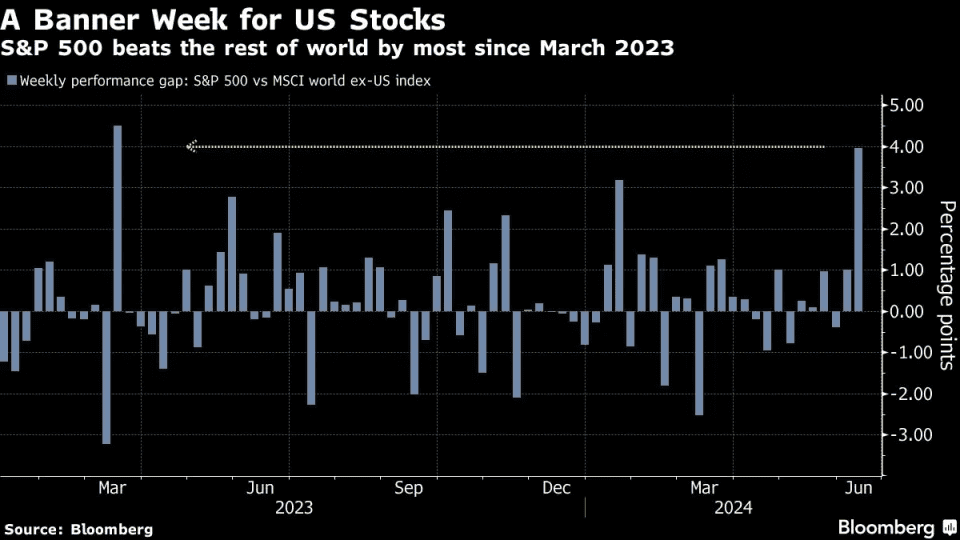

For now, the buy-America trade remains effective. This week the S&P 500 beat the global market by the largest margin in fifteen months and long-dated Treasuries saw a 3.5% increase for the greatest run of 2024.

Ignoring debt problems and growing political divides, America is becoming the only game in town for foreign businessmen desperate for stability in the face of unstable elections in Europe and China’s financial issues.

There is comparable international interest in the US credit market. In the first quarter of 2024, foreign investors invested $187 billion in US business notes, up 61% over the same period the previous year according to Torsten Slok, senior economist at Apollo Global Management.

Reports that domestic inflation is dropping and there are few signs of a recession propelled the most recent positive rise. Since the start of 2023 this has raised the total returns in the tech-heavy Nasdaq 100 to more than 80%. As a result, money invested in the rest of the world is becoming less valuable.

The US “remains the most stable nation, with a combination of AI/tech-related companies that just has no equal elsewhere in the world,” according to Wells Fargo Investment Institute senior global market strategist Sameer Samana.

He went on “Until some of these factors change, or a suitable substitute appears, its supremacy can continue a little while longer.”

The week served as a microcosm of the American asset hegemony that has dominated the market for the most of the previous fifteen years.

The 10-year yield dropped to a two-month low as investors flocked to safe havens like Treasuries, even though the Federal Reserve indicated it might reduce interest rate cuts more gradually The S&P 500, on the other hand saw its seventh rise in eight weeks thanks to technology megacaps, pushing the index over 5,400 for the first time.

Read this – Dow Jones Futures Fall: Tesla shareholders approved a massive pay deal for Elon Musk

Shares fell almost everywhere else; the MSCI World ex-US index fell more than 2%. China’s stock market has dropped for the past five weeks as further monetary easing is needed to boost the country’s weak recovery The Bank of Japan’s plans to acquire bonds are still unclear, which put more pressure on the yen.

In Europe, it was worse. In response to President Emmanuel Macron’s decision to call a quick election, French stocks fell for the first time in almost two years, wiping out all of their gains from 2024. Additionally, investors dumped the country’s bonds, causing their yield premium over safer German counterparts to rise to an all-time high each week.

“The US has the biggest and most innovative companies with strong earnings growth but profit also from its safe haven status,” said Ulrich Urbahn, Berenberg’s head of multi-asset strategy. “Momentum begets momentum.

FOMO is clearly also a reason.” While that might be true, American markets are sucking in money at a time when numerous indicators foreshadow an uncertain future.

The economy is weakening, the bond market remains antsy amid Fed policy uncertainty, and a contentious presidential election looms. All the enthusiasm for equities has pushed valuation premiums to a two-decade high.

The US asset momentum is giving anyone who is using a geographically diversified approach difficulties. Less than 7% of 644 exchange-traded funds with an emphasis on foreign assets have outperformed the S&P 500, according to data compiled by Bloomberg. However the rapidly rising stock market’s top-heavy nature is also posing risks at home.

Technology is essentially the only industry area among long-only mutual funds that has seen an increase in industry exposure this year Based on data provided by strategists Venu Krishna and others at Barclays Plc, the underweight in those portfolios has increased for banks, healthcare, and consumer discretionary companies.

The biggest tech companies command enormous weights, so chasing gains in American equities is far from risk-free, according to Que Nguyen, chief investment officer of equity strategies. at Research Affiliates.

The huge have been getting bigger for a while now, and it’s not clear that economic forces can continue this, the speaker remarked. “There will eventually be challenges to the dominance of large US companies,” she stated, referring to possible threats from smaller businesses or foreign competitors.

Source

Bloomberg

Zach Cooper is an experienced Crypto & Financial news journalist, having written for Moneycheck.com, The wall street, Computing.net and is Editor in Chief at wallstreetsights.com