An organization of Japanese crypto exchanges and blockchain companies has petitioned the government to implement coin-related tax amendments.

In an official Japan Blockchain Association (JBA) announcement, the companies requested that Tokyo implement the adjustments before the fiscal year 2025.

The JBA stated that high tax rates on cryptocurrency gains are “hindering” Japanese citizens’ efforts to save precious assets.

The group urged Tokyo to apply the same tax rate as it does to traditional financial assets like stock exchange-listed stocks.

Reform the Japanese cryptocurrency tax Now, Urges Crypto Body

The JBA includes some of Japan’s leading blockchain companies and cryptocurrency projects, such as the bitFlyer exchange. Last month, the organization said it will encourage the government to alter the country’s tight tax regulations and “focus on the introduction of” new tax measures in the next year.

The body stated that the current tax laws for cryptoasset-related transactions are unnecessarily cumbersome.

It also stated that Japan’s sliding scale taxation regime is a “reason why many investors avoid investing in cryptoassets.”

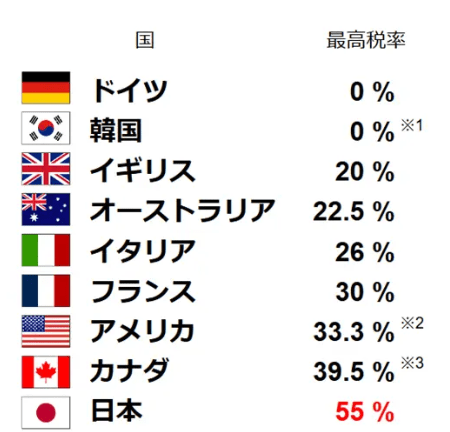

In many other nations, tax laws require crypto traders to pay flat-rate capital gains taxes on their annual income.

However, Japanese law requires dealers to report token-derived gains under the “other income” part on their tax returns.

This means that the highest-earning individuals can pay maximum of 55% tax on their crypto-related earnings.

This is far more than is the case in other leading economy nations, the JBA explained.

Crypto tax has a ‘negative impact’ on startups.

The JBA and other industry groups have already successfully lobbied Tokyo to change the crypto tax regulations that govern companies.

This means that Japanese firms will no longer be taxed on their unrealized cryptocurrency holdings.

Some MPs have expressed an interest in reforming tax rates for individual citizens. Many people propose a scenario in which cryptocurrency profits are taxed using capital gains levies.

According to the JBA, Japan’s crypto tax regulations have “a negative impact” on Japanese cryptoasset issuers and web3 startups.

The body warned that failure to modify the tax structure will reduce Japan’s competitiveness in the web3 sector.

It stated that there would be “no end” to the amount of “examples” of skilled individuals and startups that “leave the country” looking for more favorable regulation.

The JBA called on Tokyo to do the following:

- Introduce separate self-assessment tax systems for crypto. This would involve scrapping the inclusion of crypto in the “other income” sections of annual tax declarations.

- Introduce a flat rate of 20% tax on crypto profits.

- Allow traders to carry forward losses for three years, so they can be deducted from crypto-related income in future tax years.

- Abolish tax on crypto-to-crypto transactions.

- Create a system for tax-free or tax-deductible crypto donations.

- Consider further future reforms to crypto derivative transaction-related tax rules.

Matter Is Now ‘Urgent,’ Says JBA

On X (Twitter), the JBA wrote that it had “submitted a request for tax reform regarding cryptocurrencies (FY2025) to the government,”

Read more

What Is Cryptocurrency And How Does It Work?

Mike Neon is a seasoned journalist specializing in United States news, known for his comprehensive coverage of national affairs and current events. With a career spanning 5 years in journalism, Mike has established himself as a reliable source of accurate and insightful reporting. His articles delve deep into political developments, social issues, and cultural trends shaping the United States today. Mike Neon’s dedication to providing balanced perspectives and in-depth analysis ensures that readers stay informed about the latest developments that impact the nation.