Once again, stocks are closing up a trading week with new highs.

Signs of a cooling in inflation caused markets to become more hopeful about the potential of Federal Reserve interest rate cuts, and stocks soared as a result, with all three major averages reaching new highs on Wednesday.

The Nasdaq Composite (^IXIC) climbed more than 2% this week, while the S&P 500 (^GSPC) increased by more than 1.5%. On Friday, the Dow Jones Industrial Average (DJI) closed above 40,000 for the first time in history, up over 1%.

The main event driving the markets this coming week is likely to be Nvidia’s (NVDA) much-awaited earnings report. Investors will also be closely monitoring the performance of Target (TGT), Palo Alto Networks (PANW), and Lowe’s (LOW).

On the economic front, the week is anticipated to be quieter. The final reading of May’s consumer confidence and updates on the manufacturing and services sectors are scheduled. On Wednesday afternoon, the Fed’s May meeting minutes are also anticipated.

Minute by minute

The Consumer Price Index data for April indicated that core prices, which exclude the more volatile expenses of food and gas, climbed 3.6% over the previous year, the lowest yearly rise in three years. This caused investors to forecast two full interest rate cuts this year for the first time since early April.

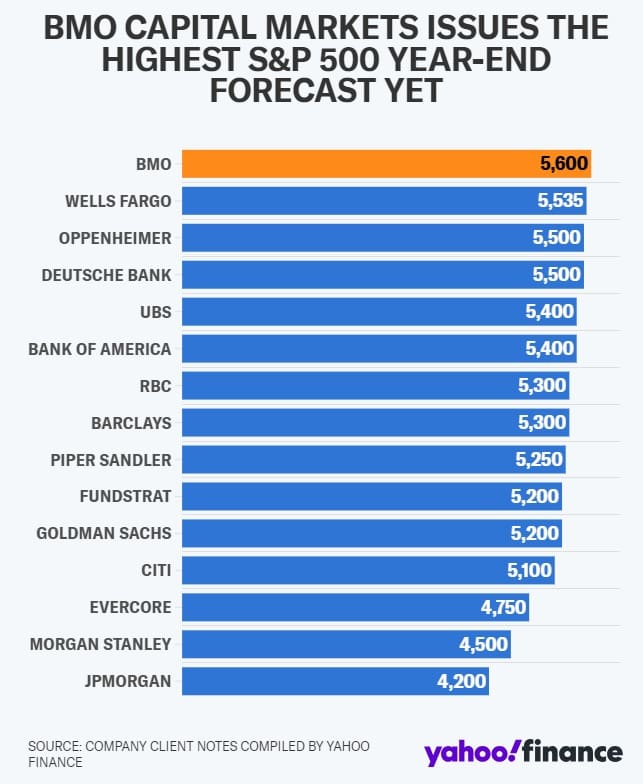

The move brings the market closer in line with the Fed’s projections of two or three interest rate cuts at some point this year. BMO Capital Markets chief investment strategist Brian Belski listed investors’ alignment with the Fed on interest rate cuts as a reason supporting his call for the S&P 500 to end 2024 at 5,600, an increase of less than 7% from Friday’s close.

For investors, the key question will be whether this bullish narrative is sustainable or if the market will once again jump ahead of the Fed as it did in early 2024 when investors priced in nearly seven interest rate cuts on the back of positive economic data.

The Federal Open Market Committee’s May meeting minutes, which will offer a more in-depth look at the conversation among officials, will be made public on Wednesday. This will be the first test.

According to US economist Michael Gapen of Bank of America, the minutes from the May FOMC meeting should sound more hawkish on the margin than Chair Powell’s press conference. “Though Powell signalled the bar for hikes is high and that standing pat is the proper response to disinflation stalling out, others on the committee were more concerned about whether the policy was doing enough.”

The bulls are on the run

Belski increased its year-end aim, and on Friday, the forecast was raised once again. Binky Chadha, chief equities strategist at Deutsche Bank, raised his year-end goal for the benchmark from 5,100 to 5,500. Chadha stated that stocks may continue to rise due to strong profit growth and a better macroeconomic outlook.

“We see the earnings cycle having plenty of legs,” Chadha stated. “While all the growth may not materialize this year, we see market confidence in a continued recovery rising by year-end, supporting equity multiples.”

The bulls are on the run

The leader in AI, Nvidia, will wrap up its earnings reports from the US tech giants on Wednesday after the closing bell. For the chipmaker, expectations are once again extremely high. According to Bloomberg consensus estimates, analysts expect Nvidia to have grown earnings by more than 400% while revenue surged by 242% in the previous quarter.

Analysts predict sales growth of about 100% and profitability growth of over 120% for the second quarter.

“We see enough room for NVDA to post FQ1E (April) revenue potentially as high as $26B (data center ~$22-23B) and potentially guide to ~$27-28B in total revenue (data center ~$25-26B) — both good enough to keep the stock biased higher, in our view,” Timothy Arcuri, an analyst at UBS, wrote in a note to clients ahead of the earnings release.

Since Nvidia’s explosive earnings release in May 2023, the stock has risen by more than 86% in 2024 and more than 200% in the previous year. Given the influence Nvidia’s stock has had on other prospective AI investments and the broader market, all eyes will be on whether the company can live up to the expectations once more.

“If [Nvidia] can continue their enviable, remarkable string of beating estimates, raising guidance, and then exceeding the raised guidance next quarter, it means that the AI trade can and will proceed apace,” Interactive Brokers chief strategist Steve Sosnick wrote in a research note on Thursday. “If there is even the smallest indication of weakness, much more than that stock alone will suffer.”

The expansion of the AI trade

Nvidia’s updates on increasing technology demand come at an important point in the overall AI tale. New enterprises in several areas are increasingly being labelled as AI trades.

Dell shares jumped almost 10% this week after analysts from Morgan Stanley and Evercore ISI published positive research on the company’s AI potential.

The AI industry has already expanded beyond well-known companies such as Nvidia, Microsoft (MSFT), Alphabet (GOOGL, GOOG), and Meta (META). This year, the S&P 500’s best-performing sectors are energy and utilities, both of which have added more than 13%. While strategists have forecasted a catch-up trade in Utilities (XLU), AI has also been a source of excitement. The same can be stated about Energy (XLE).

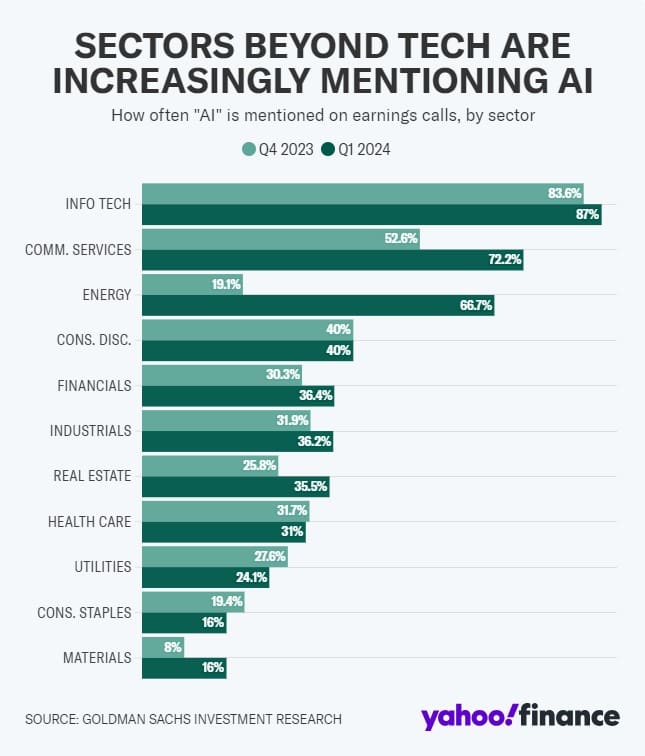

Goldman Sachs’ equities strategy team, led by David Kostin, found that mentions of AI increased in the first quarter due to a “broadening of the AI trade.” More than 66% of energy businesses cited AI during results calls this quarter, up from 19.1% the previous quarter.

Jack Manley, global market strategist at JPMorgan Asset Management, stated that whether the AI story has legs “might be one of the more important questions that we have to ask.”

“Is this AI stuff the real deal or is it a flash in the plan?” Manley informed Yahoo Finance. “And I mean, frankly, the jury is still out on whether or not it will fundamentally transform the world.”

He added, “If markets wake up to say ‘Hey, maybe we got a little bit too excited about this and maybe we pulled forward some of these earnings just a little bit, and that’s reflected in those valuations.’ That’s where I think you have the potential for a bit of a shaky road.”

Weekly calendar

Monday

Earnings: Palo Alto Networks (PANW), Trip.com (TRIP), Zoom (ZM)

Economic news: No notable economic news.

Tuesday

Earnings: AutoZone (AZO), Macy’s (M), XPeng (XPEV), Toll Brothers (TOL), Urban Outfitters (URBN)

Economic news: Philadelphia Fed Non-Manufacturing Activity, May (-12.4 previously)

Wednesday

Earnings: Nvidia (NVDA), e.l.f. Beauty (ELF), Petco (WOOF), Snowflake (SNOW), Target (TGT), TJX (TJX), Williams-Sonoma (WSM),

Economic news: MBA mortgage applications, May 17 (+0.5% previously); Existing home sales month-over-month, April (0% expected, -4.3% previously); FOMC meeting minutes

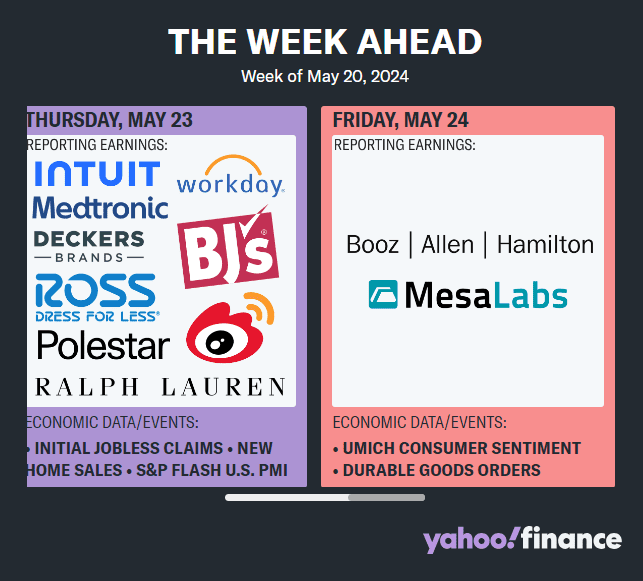

Thursday

Earnings: BJ’s (BJ), Deckers Brands (DECK), Intuit (INTU), Polestar (PSNY), Ralph Lauren (RL), Ross Stores (ROST), TD Bank (TD), Workday (WDAY)

Economic news: Chicago Fed Nat Activity Index, April (0.15 previously); Initial jobless claims, week ending May 18 (222,000 previously); S&P Global US manufacturing PMI, May preliminary (50 previously); S&P Global US services PMI, May preliminary (51.3 previously); S&P Global US composite PMI, May preliminary (51.3 previously); Existing home sales month-over-month, January (5.0% expected, -1% previously)

Friday

Earnings: Lamar (LAMR), Warner Bros. Discovery (WBD)

Economic news: Durable goods orders, April preliminary (0% expected, 0.9% prior); University of Michigan Consumer Sentiment, May final (67.6 expected, 67.4 previously)

Read more ..

The 84-year-old man who saved Nvidia

Gamestop Shares Retreat on Preliminary First Quarter Results

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.