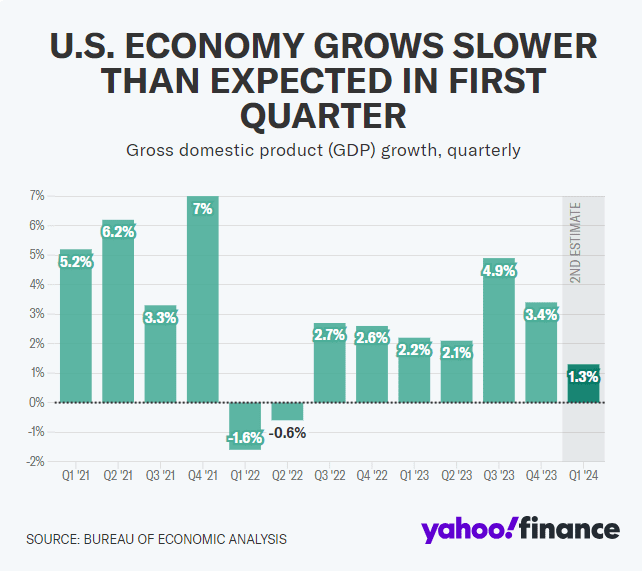

The US economy grew more slowly than expected in the first quarter.

The Bureau of Economic Analysis’s second estimate of first-quarter US GDP showed the economy grew at an annualized rate of 1.3%, down from 1.6% in April but in line with economist predictions.

According to the BEA, the first-quarter growth figure was updated principally to reflect a downward revision in consumer spending. In the first quarter, personal consumption increased by 2%, down from 2.5% the previous quarter.

The number was much lower than the fourth-quarter GDP, which was revised upward to 3.4%.

Given that inflation has turned out to be stickier than anticipated, the market has been susceptible to any data suggesting that the US economy may be heating up too much for the Federal Reserve. This coincides with the GDP deceleration. Red-hot growth raises the fear that prices may rise.

The first-quarter economic growth deceleration is not regarded by many forecasters as the beginning of a larger trend. Goldman Sachs had projected 3.2% annualized growth in the second quarter before Thursday’s result. The GDPNow forecaster at the Atlanta Fed is presently predicting 3.5% annualized growth in the second quarter.

US economist Michael Gapen of Bank of America stated in a letter to clients last Friday that although his team anticipated a lower revision to the GDP for the first quarter, this did not raise concerns for future economic development.

Reported by Yahoo Finance – “The bottom line is that the US economy moderated somewhat in the first quarter, but it remains on a stable footing overall,” Gapen wrote on Friday.

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.