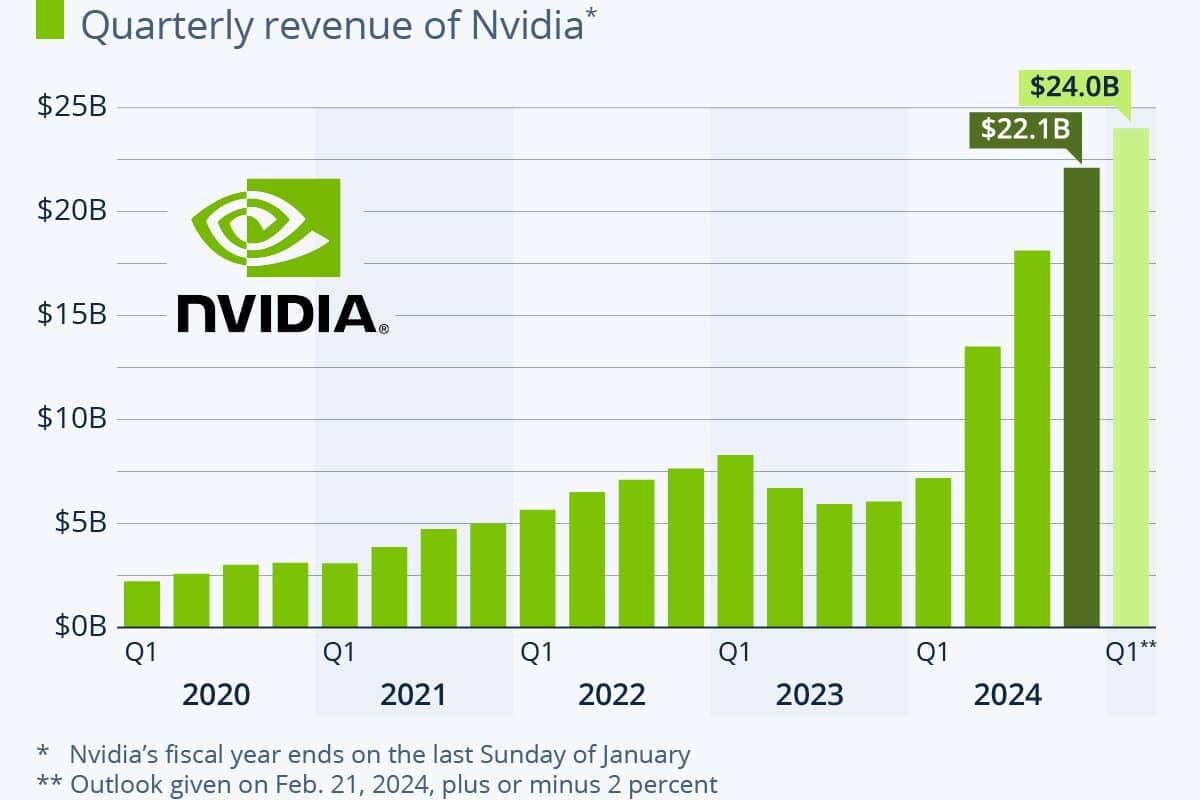

As it revealed better-than-expected results for the first quarter of its fiscal year 2025, Nvidia’s Q1 profit increased by 600%.

On Wednesday, Nvidia Corp, a pioneer in the development of artificial intelligence (AI) chips, reported a more than 600% year-on-year increase in earnings in the first quarter of this year. The company’s sales tripled during the same time, exceeding analysts’ estimates.

The impressive Q1 results prompted a rise in Nvidia’s shares throughout the extended trading session, with the stock topping $1,000 for the first time. At 19:59 GMT, the shares were trading at $1,007 per on Nasdaq, up 6.06% from the previous day’s closing.

The AI chipmaker, whose stock has roughly quadrupled in 2024 so far, has announced a 10:1 split. The move aims to make share ownership more accessible to employees and investors.

Each current shareholder as of Thursday, June 6, 2024, will get nine shares for each one owned before the split, which will be distributed after the market closes on Friday, June 7, according to the company’s filing. The corporation plans to enhance its quarterly cash dividend to 10 cents per share from 4 cents. Trading is likely to begin on a split-adjusted basis on Monday, June 10.

| Q1 FY25 | Analyst Estimates for Q1 FY25 | Q1 FY24 | |

| Revenue | $26.04 billion | $24.74 billion | $7.19 billion |

| Diluted Earnings Per Share | $5.98 | $5.19 | 82 cents |

| Net Income | $14.88 billion | $12.91 billion | $2.04 billion |

Highlights of Nvidia’s Q1 Profit Report:

The California-based tech company earned a profit or net income of $14.88 billion in the quarter ended April 28, compared to $2.04 billion in the same quarter last year. The actual adjusted profits per share were $6.12, which was more than the $5.59 predicted by LSEG.

Revenue for Nvidia was $26.04 billion, more than triple the $7.19 billion reported for the same time in 2023. The revenue recorded in the quarter under review exceeded the LSEG projection of $24.65 billion.

The positive earnings report comes at a time when Big Tech corporations such as Apple, Google, and Meta have raised their order of Nvidia processors, as they focus on leveraging the AI boom.

Additionally, the firm announced that it was raising its quarterly cash dividend by 150%, from $0.04 to $0.10 per common share. All the investors who were on record on June 11 will get the higher dividend on Friday, June 28.

In the second quarter, Nvidia estimates a revenue of $28 billion. The chief executive officer of the firm, Jensen Huang, has claimed that AI will trigger a new industrial revolution and affect every industry.

A new form of data center called an AI factory will be built to generate artificial intelligence, which is a new commodity. Companies and nations are cooperating with Nvidia to move away from traditional data centers, which cost trillions of dollars, and toward accelerated computing, according to Huang.

The excellent Q1 display propelled Nvidia’s shares in the extended trading session, pushing the company’s market capitalization value to $2.34 trillion. This is the third biggest m-cap among the listed corporations in the US market, with only Google and Apple ranking ahead of the firm.

Nvidia has also disclosed a 10-for-1 forward stock split during its first-quarter earnings announcement. The split-adjusted shares are expected to start trading at the market opens on June 10. On Wednesday, Nvidia’s shares finished at $949.50.

Following a 10-for-1 stock split at that price, the cost per share would be decreased to $94.95. Investors would need to acquire 10 shares post-split to keep similar ownership in the firm as they had with a single share before the split.

Read More:

The 84-year-old man who saved Nvidia

Upstox and Investopedia

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.