SK Hynix Inc. (000660.KS) warned of increased volatility in the second half of 2025 despite resilient demand for AI memory chips from big tech providers, reflecting the uncertainty surrounding US tariffs.

Table of Contents

Stockpiling ahead of Trump’s tariffs helped the Korean company achieve a better-than-expected 158% increase in operating profitability for the March quarter. The high-bandwidth memory required for Nvidia Corp.’s (NVDA) AI accelerators, which power massive data centers constructed by companies like Microsoft Corp.

(MSFT) and Amazon.com Inc. (AMZN), is expected to double in demand, according to SK Hynix’s projection.

HBM shipment growth guidance is encouraging

Sanjeev Rana, an analyst at CLSA Securities Korea, said it is reassuring that SK Hynix is sticking to its HBM shipment growth guidance. “How will the tariffs affect tech demand in the latter part of the year?” is the main query on everyone’s mind.

Businesses worldwide are preparing for demand slowdowns brought on by Chinese limitations on rare metals, US tariffs, and export restrictions on AI chips. Microsoft has halted its global data center projects, while analysts have reported that Amazon is halting certain kinds of data center agreements.

With its shares up just 3% this year, SK Hynix’s stock progress has been delayed by those worries. In keeping with the overall market, the company’s stock price dropped 1.7% Thursday afternoon in Seoul.

During an earnings conference call, Chief Financial Officer Kim Woo-hyun informed analysts that it is now impossible to evaluate the impact of US tariffs.

“It is now more difficult than ever to forecast future market conditions due to the growth of protectionist policies like export restrictions and tariff regulations,” he said.

Although roughly 60% of the company’s income comes from American customers, the proportion of direct exports to the US is “not that high,” with memory shipments for US customers frequently ending up outside the US, he said.

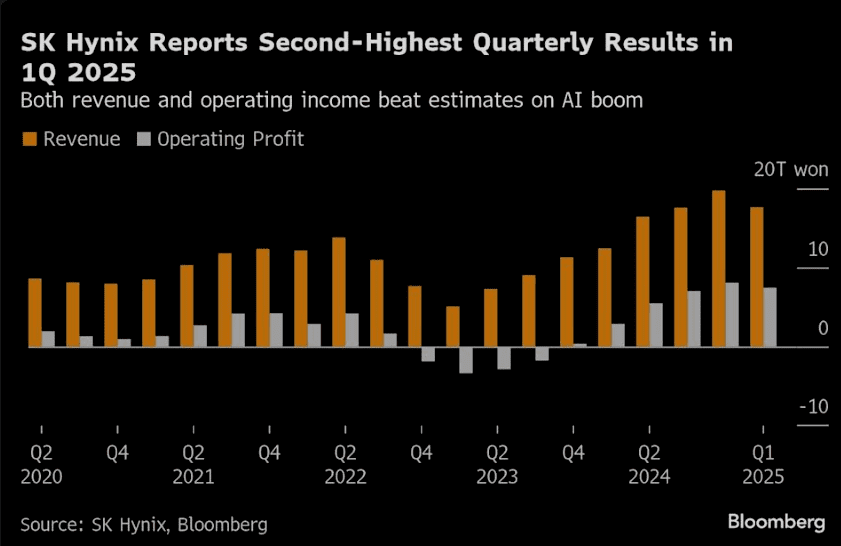

SK Hynix announced operating profits of 7.44 trillion won ($5.2 billion) for the March quarter, which was higher than projected despite a 42% increase in revenue.

Following record revenue and operating profit in the previous quarter, the company recorded its second-highest quarterly performance thanks to customers’ requests for faster shipments of sophisticated chips and memory used in PCs and smartphones.

Executives at SK Hynix also tried to convince investors that excessive customer inventories brought on by tariff-driven stockpiling wouldn’t reduce demand and negatively impact profitability in the second half of the year.

According to them, chipmakers are more likely to temper output plans and account for market uncertainty, which would limit the size of potential supply gluts or abrupt declines in demand.

According to Icheon, a South Korean corporation, DeepSeek’s low-cost models have also encouraged businesses and governments worldwide to increase their investments in AI infrastructure.

One of the executives stated, “This has led us to believe that there is no doubt that HBM will continue to experience strong long-term growth in demand.”

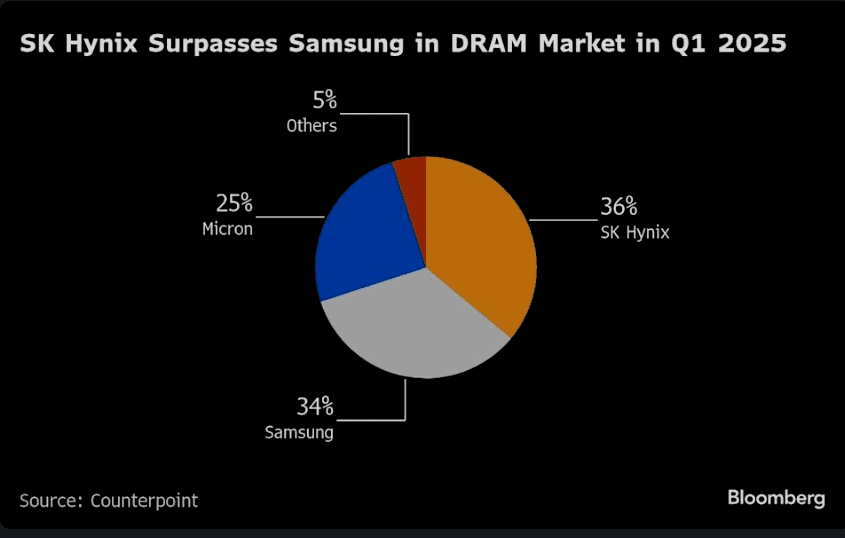

For the first time in their decades-long competition, SK Hynix was able to surpass Samsung Electronics Co. as the leading DRAM vendor in the world thanks to impressive performance. During the call, executives acknowledged the milestone and pledged to continue to lead the competition.

To maintain its dominance, SK Hynix is growing its high-end DRAM manufacturing and collaborating with Nvidia on its next-generation HBM4.

SK Hynix Plans $15 Billion Chip Expansion to Meet AI Demand

According to the corporation, the M15X factory, which is being built in Cheongju, a city in the south, is expected to open in the fourth quarter. It is estimated that over 20 trillion won will be invested in the site overall.

The company said it’s expecting a slight increase in capital expenditure, maintaining its previous stance.

Sales of 12-layer HBM3E, a key component of the business’ AI memory strategy, are anticipated to rise to more than half of all HBM3E revenues in the second quarter, according to SK Hynix. That chip, which complements Nvidia’s graphics processing units, is now the most sophisticated HBM available.

Source : Bloomberg , Yahoo Finance

Most Read from The Wall Steet

Trump Blames Zelensky as Ukraine Peace Efforts Falter

NVIDIA Company Announces Financial Results For Second Quarter FY 2025

The 84-year-old man who saved Nvidia

Andrew is a New York-based markets reporter at The Wall Street , covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. He is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. He holds BTC and ETH.