Investors pushed JPMorgan Chase (JPM) and Wells Fargo (WFC) stocks higher Friday after third-quarter results were better than expected, demonstrating the banking titans’ resilience and pointing to the potential of a soft landing for the US economy.

One JPMorgan official was even willing to link the bank’s performance to the gentle landing, highlighting the lender’s consumer and corporate client strength. A soft landing occurs when inflation slows but does not cause a recession.

“Broadly, I would say these earnings are consistent with the soft-landing narrative,” the bank’s CFO, Jeremy Barnum, told reporters. And the fact that businesses are hopeful, he said, is “pretty consistent with this kind of Goldilocks economic situation.”

JPMorgan and Wells Fargo’s profits decreased 2% and 11% respectively from the previous year, but the falls were less than Wall Street predicted.

They both profited from significant increases in investment banking as a two-year dealmaking drought appeared to be ending. Wells Fargo’s investment banking fees increased 37% year on year, while JPMorgan’s grew 31%.

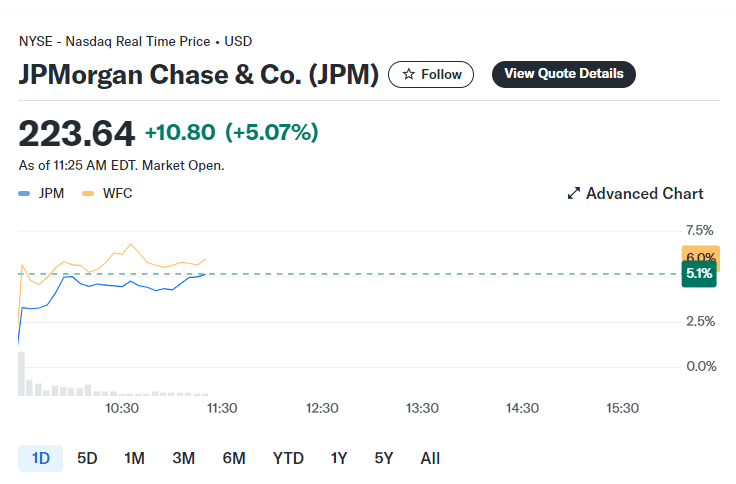

JPMorgan’s shares jumped more than 4% in early Friday trade, while Wells Fargo’s stock increased more than 5%.

JPMorgan Chase & Co. (JPM) Stock Performance

The results kicked off the third quarter earnings season, as lenders wonder how a new Federal Reserve rate-cutting cycle will effect the largest US banks over the coming year.

Their competitors, Citigroup (C), Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), are set to announce their earnings next week. Their stocks all increased on Friday.

One pleasant surprise in JPMorgan‘s reports was that net interest income, a key metric of lending profit, climbed in the third quarter. The bank also increased its annual net interest income forecast by $1.5 billion.

Read more

European Markets React to Halt in China Equity Surge

NVIDIA Company Announces Financial Results For Second Quarter FY 2025

Michael Burry Stock market crash by $1.6 Billion

Daisy Morgan is a dedicated business journalist known for her insightful coverage of global economic trends and corporate developments. With a career rooted in a passion for understanding the intricacies of the business world, Daisy brings a unique perspective to her writing, combining in-depth research with a knack for uncovering compelling stories. Her articles offer readers a comprehensive view of market dynamics, entrepreneurship, and innovation, aiming to inform and inspire professionals and enthusiasts alike.